Google AdX will amend its video policy on April 1 (April Fools’ Day) to meet new industry standard standards for instream and outstream video.

Some publishers and video ad networks are wondering if the joke’s on them.

A huge portion of previously premium material – such as inventory that sellers previously offered as “premium” – may soon see lower CPMs.

To be honest, the new video guidelines aren’t entirely new. They were first provided by the IAB Tech Lab in the summer of 2022, then revised with industry comment in March before being incorporated into the OpenRTB protocol. Google first told publishers about its AdX transition plan a few months later and has been working to implement it since.

READ MORE: In 2024, Amazon Prime Video Is Expected To Generate Over $1 Billion In Advertising Revenue

However, reality sets in on April 1.

Google operates the market’s most significant supply-side platform, and its adoption of these specifications is a watershed moment for a category of online video companies whose bread and butter is monetizing a type of video content that may no longer be as profitable as it once was.

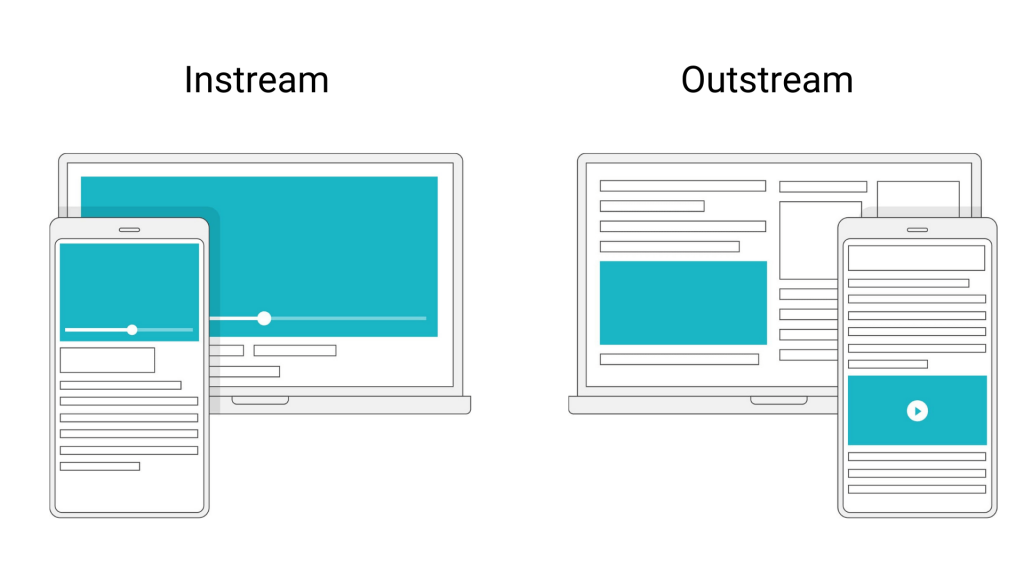

The Tech Lab modified its video standards to make the distinction between instream and outstream video more clear and formalize it in a way that can be communicated in the programmatic bidstream.

Previously, Hillary Slattery, senior director of programmatic product at the IAB Tech Lab, used the term “instream” to refer to premium video inventory.

However, most of what was classed as “premium” did not necessarily fulfill an advertiser’s standards for premium video, such as pre-roll or mid-roll in an autoplay video with the sound turned off by default, or floating autoplay videos that display with non-video content. According to the Tech Lab’s new criteria, publishers can no longer classify this type of video as instream in bid proposals.

READ MORE: OpenAI Takes On Hollywood With Video Creation Tool

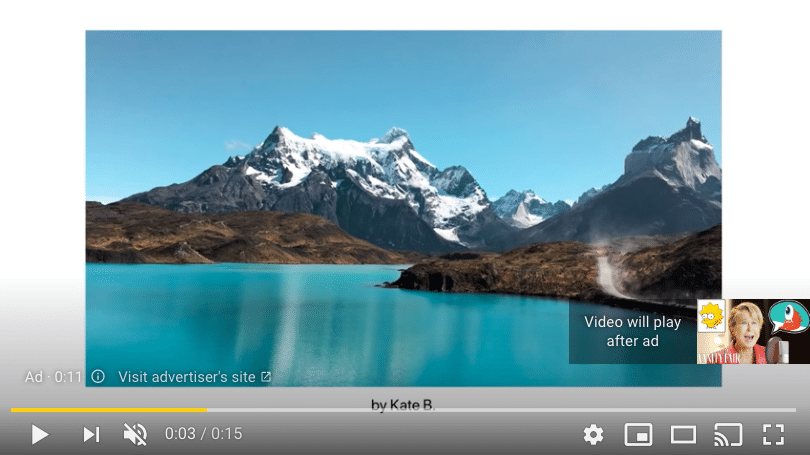

Now, instream only refers to what advertisers call a “YouTube-like” experience in which consumers enter on a page intending to watch a video and, because they commence playback, the sound is switched on by default.

The new OpenRTB specification does not have an explicit “outstream” designation; instead, non-instream placements are classified into three categories: “accompanying content,” “interstitial,” and “no content/standalone.”

Accompanying content includes pre-roll, mid-roll, and post-roll videos that begin playing only when a user views them. Most crucially, the video player incorporates some type of publisher-provided content, not merely advertisements. The content is muted by default. The accompanying content label also applies to video players that appear between or after paragraphs of text or images, as well as embedded players that transition to floating players.

Interstitials are video ads that play without content, cannot be scrolled past, and take up the majority of the on-screen space.

No content/standalone refers to video spots that just show advertisements and have no other content. The format is irrelevant; it could be a sticky or floating player, a slideshow, a native placement, or an in-content banner between paragraphs. This is what most advertisers envision when they think of “outstream.”

Publishers and SSPs that implement the new standards must determine if their video is instream or falls into one of the three outstream buckets when employing the new video.OpenRTB bid requests contain a plcmt field.

Outstream fallout

Before the IAB Tech Lab introduced its new video standards, publishers could, and did, classify what is now known as accompanying material as instream in their bid requests, according to Eric Hochberger, co-founder and CEO of Mediavine, a publisher monetization platform.

Many publishers continued to do so on Google’s platform, despite other SSPs’ updates.

A nice example of accompanying content is when a publisher’s video monetization provider develops video inventory just for running advertisements against. For example, Connatix, EX.CO, and Primis provide solutions that ingest article copy and integrate it with additional media assets like stock video or static graphics to produce monetizable videos. (The accompanying footage includes both professionally produced video and AI-generated assets.)

READ MORE: 3 Lessons IT Leaders Can Learn From Astronauts About Digital Transformation

The Tech Lab working group that developed the new video standards advocated for the development of a separate category for accompanying content to distinguish it from outstream, Hochberger explained, because marketers equate outstream with low-quality advertisements.

In practice, however, purchasers prefer to think primarily in terms of in-stream and out-stream, and they still regard accompanying information to be on par with outstream, he explained.

As a result, publishers testing the new AdX standards have seen their content revenue decline.

Test results

Multiple publishers who spoke with AdExchanger anonymously said that AdX revenue from accompanying content had dropped by 20% to slightly more than 60%.

One international news site’s revenue from companion material plummeted 63%, while a sports publisher’s revenue fell 60%. The average fall across three local news sites was 56%, while a financial news site experienced a 35% drop and a vacation site witnessed a relatively moderate 19% decrease.

READ MORE: Discrepancies In CTV Advertising Revenue Distribution Endanger Free-To-Air Broadcast TV Channels

However, when factoring for demand from other SSPs, these same publishers saw a 15% income reduction on average, indicating that other SSPs have already made the required modifications.

According to Andrew Fowler, president of revenue operations at ad ops startup Aditude and chairman of the Prebid Video Taskforce, most SSPs have already incorporated the new bid criteria.

AdX has been a noticeable exception. On April 1, however, when AdX implements the new criteria, online video platforms that depended on the industry’s previously ambiguous definition of instream and outstream content may lose access to one of their most important sources of demand.

What happens next for video monetization platforms?

There are three possible outcomes when Google switches on AdX in only two weeks.

YouTube will continue to be sold at instream’s premium price point, but some outstream inventory may become slightly more valuable, and advertisers may depreciate accompanying content.

READ MORE: More Than 30 European Media Organizations Have Sued Google Over Advertising Technology

The latter may cause problems for video platforms that specialize in automated video generation for their publisher clients.

However, publishers have alternative options for offsetting revenue shortfalls in one video genre by favoring another. For example, they may generate more YouTube-style video that adheres to in-stream rules.

And, assuming advertisers pay roughly the same price for accompanying content as they do for no content/standalone video inventory, publishers could likely provide more impressions – and make more money – by solely running ads in their floating video players, according to Aditude’s Fowler.

He predicted that the days of AI-generated accompanying content would be coming to an end. (Which would be ironic given the hype surrounding generative AI.)

So, how will the video platforms that sell these AI-powered solutions respond?

Connatix, which has long specialized in what is now known as accompanying content, has no plans to abandon the format, according to Luca Bozzo, the company’s director of programmatic operations and partnerships.

However, Connatix is attempting to increase its portion of instream by providing consumers greater choice over playback and working directly with publishers to create content that is similar to the YouTube experience, he said. Currently, approximately 10% to 15% of Connatix’s inventory qualifies as instream.

EX.CO still provides a service that generates monetizable video content from existing publisher assets, but it stopped actively selling it last year to focus on monetizing professionally created video, according to a company representative.

Another video platform, which asked not to be named, stated that if accompanying content becomes too difficult to monetize, it would shift its attention to instream, and it may even explore launching an outstream offering for no-content/standalone placements.

Meanwhile, publishers will have to wait and watch how things play out on the demand side, and they may have to cope with another revenue stream being constrained until the problem is resolved.

A Google spokeswoman told AdExchanger that AdX’s adoption of the new video standards will “positively benefit both publishers and advertisers by providing clarity on requirements for accurately representing inventory.”

So, there you go. Google says everything will be OK. There’s no foolin’.

Radiant TV, offering to elevate your entertainment game! Movies, TV series, exclusive interviews, music, and more—download now on various devices, including iPhones, Androids, smart TVs, Apple TV, Fire Stick, and more.