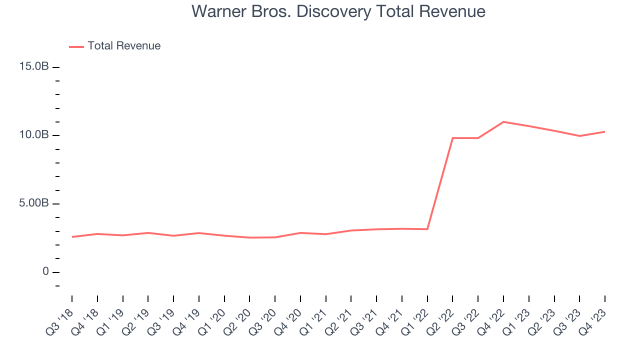

Warner Bros. Discovery is in a difficult situation, since its TV revenue is declining by double digits and growth opportunities such as streaming media are failing to compensate. (Yet.)

Last quarter, WBD’s overall revenue declined 7% year on year, while revenue from linear TV ad sales fell 14%. WBD isn’t giving up on linear, but it expects its streaming business, as well as additional investment in sports programming, to offset losses and bring the company to profitability.

WBD’s overhauled streaming service, Max (which mixes HBO Max and Discovery+ content), is still in its “early innings,” CEO David Zaslav told investors during the company’s earnings call on Friday. However, the studio’s prime priority is “driving profitable growth” for Max.

READ MORE: Disney, Fox, And Warner Bros.’s New Sports Streaming Service Is Being Sued by Fubo

However, Zaslav stated that there is still “a long [distance] left to go” down that path.

Max is the light at the end of WBD’s tunnel, which is currently dark.

WBD reported a 51% year-over-year gain in streaming ad income compared to the fourth quarter of 2022, before HBO Max relaunched as Max. Gunnar Wiedenfels, CFO, also stated that the rate of growth in streaming ad income is increasing.

That number may sound good, but it’s not surprising: advertisers prefer centralized streaming purchases, which is why so many media businesses bundle their content. (Other examples are Disney+ and Hulu.)

Consumers also prefer to get their content in one location. While the studio only added half a million streaming customers in Q4 (excluding members acquired from Turkish streamer BluTV in December), Max had the lowest churn rate “in HBO Max’s history” last quarter, Zaslav claimed.

Stable subscriber numbers, combined with an increase in streaming ad revenue, would explain why WBD’s average revenue per streaming user increased 7% year over year to $7.94.

Criteo investors seek a strategic acquirer, as the FTC fines Avast. WBD aims to boost streaming growth through globalization and additional content.

Currently, Max with advertising is only accessible in the United States. Some overseas locations still have ad-supported HBO Max, but it will be available in Latin America next week, followed by Europe, Asia, Africa, and the Middle East later this year. By the end of the year, Max with advertisements will be available in over 40 worldwide regions, according to Zaslav.

To take advantage of a global launch, WBD is investing in a new content slate based on its well-known properties.

Another “Game of Thrones” prequel, “A Knight of the Seven Kingdoms,” will air in 2025, and a new “Harry Potter” film will be released in 2026.

But most importantly, WBD is focusing on sports.

It’s no surprise that Max’s international expansion coincides with the Summer Olympics in Paris. Although NBCUniversal owns the television and digital rights, WBD will webcast the games on its Eurosport channel.

Max also intends to increase foreign subscriptions with other sports programs by capitalizing on the Olympics’ buzz. For example, Zaslav stated that WBD is now in talks with the NBA about renewing its rights.

Last but not least, WBD announced a new joint venture with Disney and FOX, which will develop a sports-focused streaming service in 2025. Max subscribers will be able to download the app as part of a bundle.

But only if the app genuinely exists. Pay TV firms and the Department of Justice have raised antitrust concerns about the venture’s structure; according to Citi analysts, the three studios collectively own 55% of US sports rights. And Fubo, a sports-focused programming distributor, filed a lawsuit earlier this week alleging anticompetitive business activities between the broadcasters.

Only time will tell if WBD can reclaim ground in the streaming market share race.

Radiant TV, offering to elevate your entertainment game! Movies, TV series, exclusive interviews, music, and more—download now on various devices, including iPhones, Androids, smart TVs, Apple TV, Fire Stick, and more.