SiriusXM revealed its Q4 and full-year 2023 financial figures, disclosing that the service lost 445,000 self-pay subscribers over the last year.

The radio behemoth attracted 131,000 self-pay subscribers to its satellite radio offering in Q4, following declines in the preceding three quarters—96,000 (Q3), 132,000 (Q2), and 347,000 (Q1). SiriusXM lost 430,000 consumers in Q4 due to a reduction in 445,000 self-pay subscribers, while increasing paid promo users by 15,000.

READ MORE: SiriusXM’s Subscriber Count Plateaus At 34 Million, While Pandora’s Decline Continues

SiriusXM’s self-pay subscriber base appears to be approximately 31.9 million, with a total of 33.9 million customers. The company expected a reduction in users for the entire fiscal year 2023 because to obstacles posed by a tight economy and shifting commuter and car sector habits.

The Pandora sector lost 109,000 subscribers in Q4, compared with 52,000 in Q4 2022. Pandora lost 207,000 subscribers in 2023, leaving it with approximately 6 million self-pay streaming consumers. Pandora’s quarterly advertising income was $479 million this quarter, down from $480 million the year before.

SiriusXM’s total revenue for the fourth quarter was $2.29 billion, with a projected revenue of $8.95 billion for 2023. The corporation recorded a net income of $352 million for the fourth quarter, down 4% from $365 million in 2022, although net income for the entire year was up 4% ($1.26 billion) from $1.21 billion in 2022. Adjusted profits before interest, taxes, depreciation, and amortization (EBITDA) decreased 4% to $715 million in the fourth quarter and 2% for the year to $2.79 billion.

READ MORE: WILL.I.AM Announces QD.PI, A Radio Show With AI Co-Host

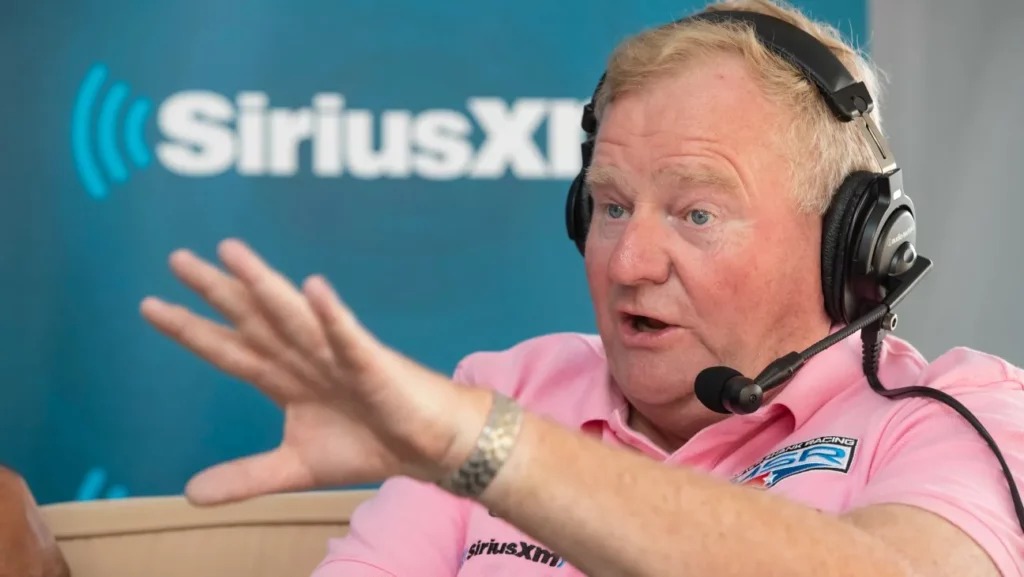

SiriusXM anticipates $8.75 billion in sales for 2024, a decrease from 2023, and $2.70 billion in adjusted EBITDA. “In 2023, SiriusXM laid the groundwork for future growth through the successful launch of our next-generation platform and the new SiriusXM app,” Jennifer Witz, president and CEO of SiriusXM, said.

“Our dedication to growth was also evidenced by strategic content investments that increased our reach to new listeners while remaining true to our identity as a destination for curated, live, and on-demand audio experiences. As we look to 2024, our guidance represents significant efforts and investments in improving the value offer of our subscription and advertising businesses, which we believe will increase our long-term growth profile.”

Radiant and America Nu, offering to elevate your entertainment game! Movies, TV series, exclusive interviews, music, and more—download now on various devices, including iPhones, Androids, smart TVs, Apple TV, Fire Stick, and more.