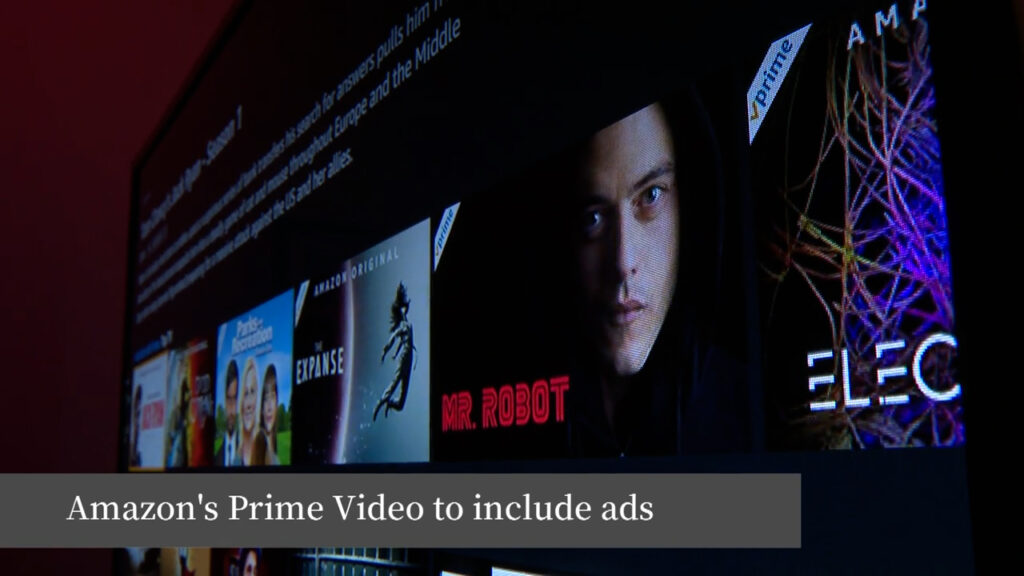

It never occurred to me that I would get paid to see Snoop Dogg’s most recent film, but here we are. As the newest player in the AVOD streaming competition, Prime Video is now experimenting with advertisements.

Skepticism is present from the start. The default of advertisements is being protested by customers, some of whom are threatening to terminate their subscriptions rather than pay an extra $3 a month to avoid them. Despite the promise of broad reach and lower CPMs than competitors, Insider Intelligence claims that media buyers were unimpressed with Prime Video’s pitch deck.

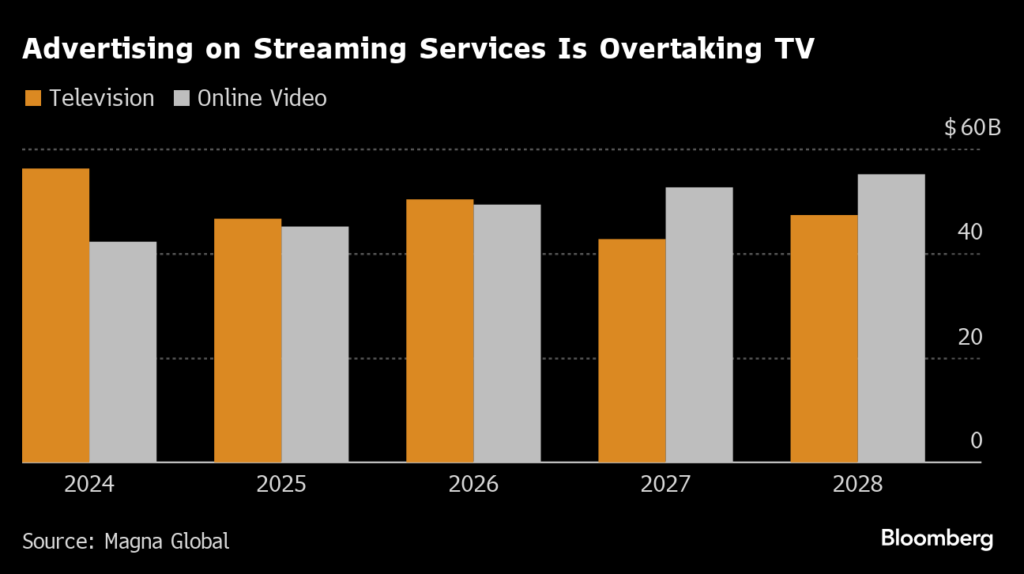

However, advertisers will have yet another option to divert their investment from linear TV if Prime Video can convince its users to remain active and view ad-supported content.

I decided to check out the ad experience for myself when it launched on Monday. I watched four episodes of Everybody Hates Chris, four episodes of Chicago P.D., eight episodes of Judy Justice, and four episodes of “The Underdoggs,” a recently released film co-directed by Snoop Dogg that I do not suggest.

READ MORE: In 2024, Amazon Prime Video Is Expected To Generate Over $1 Billion In Advertising Revenue

The most notable aspect of Prime Video’s commercial experience, in my opinion, was the noticeably reduced ad load, but frequency control might need some work.

Customers may be assured by Prime Video that there won’t be an excessive amount of advertisements, even though they are enabled by default. This week, when subscribers checked in, they received an interstitial telling them that “movies and TV shows included with Prime now have limited ads.”

In my experience, this was also the case: out of the 16 TV shows I viewed, the average amount of advertising I saw was slightly more than 1.5 minutes per hour of content, which was less than the 2-3 minute estimated ad load that was stated in the pitch deck.

READ MORE: Spotify And Warner Bros. Discovery Reach A Podcast Advertising Agreement

Since too many advertisements irritate users, a minimal ad volume may help Prime Video lower customer turnover. And while other big streaming services used to take pride in having few advertisements, almost all of them have progressively raised their volume of adverts throughout the past year.

There were a variety of 15- and 30-second pre-roll and mid-roll advertisements on Prime Video. There were just one or two commercial interruptions during each naturally occurring segment of the show, so the experience wasn’t overly interrupted.

It should come as no surprise that Prime Video advertisements promoted goods that could be bought on Amazon.com, such Samsung Galaxy phones, by employing ad creatives that seemed tailored for the platform. Large national brands including DraftKings, Expedia, Colgate, Chewy, Priceline, Virgin Atlantic, Zipcar, and skin care company LaRoche-Posay are among the other nonendemic marketers airing on Prime.

READ MORE: ANA Research Shows That 25% Of Automated Advertising Dollars Are Wasted

However, in my experience, house ads—that is, advertisements on Amazon promoting its own titles on Prime Video and Freevee, the company’s free streaming service that was formerly known as IMDb—were the most prevalent kind of marketing. (Amazon just reorganized the leadership to give Prime Video priority and brought additional Freevee titles to Prime Video.)

Twelve out of the twenty-eight advertisements that I saw on the site, or almost 43% of all commercials, were for Prime Video or Freevee films that could be streamed on Prime Video.

That’s a high enough figure to make me wonder, for a moment, just how much demand Prime Video secured from advertisers. However, given its extensive reach and inexpensive cost (ads may reach 115 million users and have CPMs ranging from $26 to $41), it’s also possible that Amazon is only promoting its own titles in an effort to drive up Prime Video viewership.

More involved viewers ought to draw in more sponsors, after all.

READ MORE: CTV/OTT Programmatic Advertising

Despite the low volume of the advertisement, I did notice some repetition.

I was served four advertisements during two back-to-back episodes of “Judy Justice,” all of which promoted Colgate toothpaste. Additionally, I saw two Chewy advertisements in the same “Everybody Hates Chris” episode.

Fair enough, each brand had two other creatives, which lessened the starkness a little. Two advertisements with distinct creatives might have fit inside a brand’s frequency cap. However, having several commercials for the same company in one show is not ideal because it makes me and probably other viewers feel overstimulated.

When I inquired about frequency controls, an Amazon representative responded, “We have processes in place to manage ad frequency for customers.”

During launch week, I too had my viewing experience. After debut, Prime Video will probably add more diverse advertiser clients to its list. And it will be interesting to observe how its subscribers are affected by the addition of commercials (and whether or not those who are complaining stay subscribers).

What I want to know is how more established AVOD companies will compete with Prime Video for TV ad spending at this year’s upfronts.

Radiant and America Nu, offering to elevate your entertainment game! Movies, TV series, exclusive interviews, music, and more—download now on various devices, including iPhones, Androids, smart TVs, Apple TV, Fire Stick, and more.