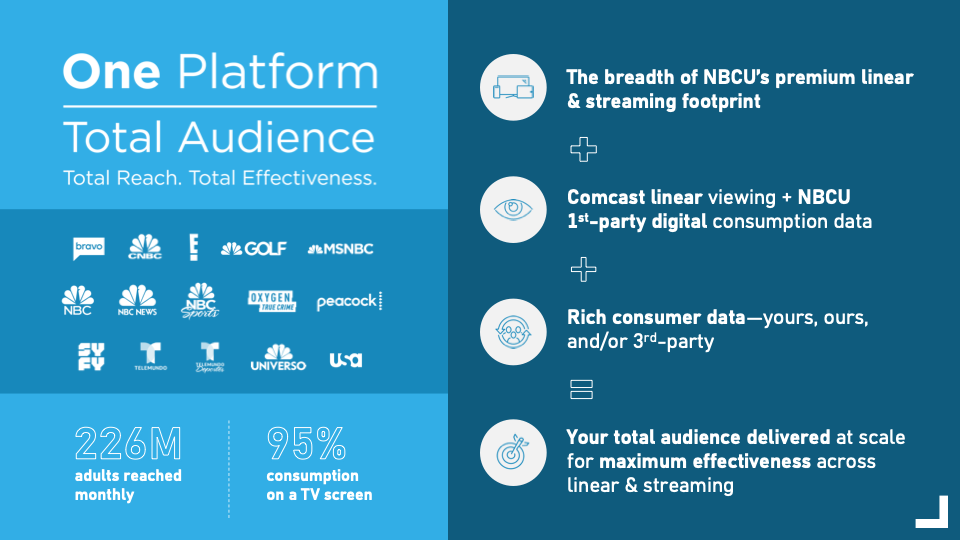

This week at CES in Las Vegas, NBCUniversal is kicking off the new year with a programmatic status report.

About thirty percent of the ads on Peacock are sold programmatically, two years after NBCU started offering programmatic ads on the platform. While the growth of linear TV ads is leveling off (or perhaps dropping) for certain networks, NBCU saw a 50% increase in programmatic ad income in 2022 compared to the previous year.

A large portion of this growth, according to NBCU, can be attributed to new collaborations with alternative demand-side platforms that cater to small and medium-sized advertisers, such StackAdapt, Simpli.fi, and Blockboard.

READ MORE: During The Strike, Local ABC, CBS, FOX, And NBC Stations Saw A 37% Decline In Primetime Ratings

According to Ryan McConville, NBCU’s EVP of ad platforms and operations, programmatic offers “a really big opportunity for smaller companies to get into streaming” by making the process of purchasing TV advertising simpler. McConville made this statement to AdExchanger. And for publishers, more brand clients translate into more ad revenue.

To attract more marketers, NBCU focused specifically on identity, retail data, and live events.

In the past year, a lot of streamers have focused on live events, especially sporting events.

According to McConville, NBCU introduced the great bulk of Peacock’s live content last year. In February, the advertising were first sold programmatically, primarily through Roku’s OneView DSP and The Trade Desk. Naturally, as NBCU expanded the DSPs via which it made its supply available during the course of the previous year, demand for live inventory skyrocketed.

When compared to this time last year, the number of sponsors supplying programmatic advertisements to live programming on Peacock has increased by 117%, according to the programmer.

According to McConville, NBCU began indicating to bidders in late-2017 whether the ads it calls for are for live or on-demand content. The ability to target viewers who are concurrently watching the same item makes TV appealing to certain advertisers.

According to McConville, increasing the level of specificity in the bid stream can draw in more advertisers that are solely interested in live TV supply, in addition to meeting the buy-side’s requirement for transparency. For instance, because appointment viewing has a high level of engagement, many marketers wish to add live events to their programmatic campaigns.

Speaking of signals, McConville stated that data is what piques marketers’ interest in continuing to fund programmatic advertising.

Moreover, retail data is very popular at the moment.

NBCU participated in the Amazon Publisher Cloud beta program, which was introduced in October and allowed publishers to compare their data with the company’s consumer database. During the summer, NBCU and Walmart collaborated to explore the effects of shopper marketing initiatives on Peacock.

Advertisers can only obtain this data for Peacock buys through the DSPs of Amazon and Walmart, respectively, so both companies are legitimate walled gardens. Still, it’s a start. Although it’s too soon for NBCU to reveal specific findings from these retail integrations, McConville noted that purchasers’ need to be able to “apply retail data to streaming audiences” is important.

Regarding identity, NBCU is among a number of affiliated TV presenters who are wagering on UID2.

Cookie deprecation can complicate CTV ad targeting, even though browser-style cookies have never been utilized in CTV inventory. It is becoming more difficult for advertisers to compare the effectiveness of their streaming campaigns to other channels, such as retargeting. As a result, consumers are depending more and more on IP addresses for household matching or campaign attribution (i.e., linking an advertisement to an online transaction). UID2 is being used by a lot of media businesses and brands especially for CTV because it groups UIDs by home using IP addresses.

While McConville would not provide specifics about the study, NBCU began testing UID2 with The Trade Desk last year. According to McConville, UID2 has shown to be a more dependable identity signal for cross-platform campaigns than third-party data.

Additionally, more sales will be made by NBCU the more it can link its programmatic supply to actual transactions.

According to McConville, the keys to unlocking streaming ads for a much wider range of advertisers will be retail and programmatic automation.

Radiant and America Nu, offering to elevate your entertainment game! Movies, TV series, exclusive interviews, music, and more—download now on various devices, including iPhones, Androids, smart TVs, Apple TV, Fire Stick, and more.