Leading figures in the ad-tech industry predict some shifts for traditional advertising in 2024, following a challenging year.

Connected TV as an advertising channel, the demand for reliable data, and the ongoing automation trend are all becoming more and more significant.

Here are a few forecasts for the year 2024.

According to Mark McKee, general manager of Comcast’s ad tech business FreeWheel, “we’ll see a renewed focus on premium video—what it is and what factors buyers and sellers should consider when engaging in video transactions in 2024.” “This issue is pertinent given the growth of premium video and the proliferation of content across screens and devices. Buyers want (and ought to know) that the ad inventory they’re acquiring is high-quality and brand-safe in today’s complicated and rapidly evolving media market. The industry will benefit from holding premium video to a higher standard since it will result in a better viewing experience.

READ MORE: Google Is Introducing Programmatic Bidding For Limited Ads

Larry Allen, VP and GM of data and addressable enablement at Comcast Advertising, stated that the introduction of AMC Networks’ programmatic addressable capability was one of the most innovative events of 2023. We anticipate a significant rise in addressable ad inventory becoming programmatically available in 2024 as a result of this discovery. Along with a greater focus on verified identity, this will open the door for innovations in TV ad ecosystem measurement and audience targeting that are even more precise.

Three decades prior, “What is TV?”asked a simple question that had a simple response: “TV” was any content that showed up on your TV screen, regardless of how you watched it or whether it was a TV show or advertisement. Easy. However, in the last fifteen years, the answer has grown much more nuanced, and the distinctions between “TV” and “digital video” have gotten increasingly hazy, according to Krim.

According to him, “2023 saw a major shift in how EDO’s clients planned and budgeted for ‘TV,’ with YouTube almost always being included in TV budgets after years of being included in social video budgets.”

“This trend will only pick up speed in 2024 as networks, agencies, advertisers, and streaming platforms begin to define ‘TV’ as ‘high-quality video content,’ regardless of how, when, or where we access it,” according to Krim.

READ MROE: CTV/OTT Programmatic Advertising

Programmatic TV advertising has advanced dramatically as TV moves more and more towards digital media. According to Krim, that will put pressure on consumers and advertisers to start making direct inquiries about the data they are utilizing.

According to him, “programmatic will continue its convergent TV invasion in 2024 as advertisers chase the allure of combining the precise targeting they use to buy programmatic banner ads with the highly engaging, premium environment of TV.”

The correctness of the data is a critical component of the audience-targeting ecology, and this programmatic trend will ultimately force us to face it. Nearly half of the data utilized in digital audience targeting is blatantly inaccurate, per a recent Truthset study. Furthermore, a lot of purportedly “premium” programmatic TV ad purchases end up being trafficked on subpar websites rather than providing customers with the high-end TV app experience they were hoping for. “These quality issues will come under intense scrutiny as media costs rise during an election and Olympic year,” stated Krim.

The final result? According to Krim, 2024 will be the year when marketers truly begin examining the data they have invested in to make their programmatic TV buying strategy shine.

“Therefore, this will force the demand side platforms (DSPs) and sell side platforms (SSPs) to address another significant disparity – the majority of platforms solely focus on audience targets and cost reduction, whereas industry leaders like Google optimize for results,” Krim stated. “A more holistic approach to performance, as opposed to just evaluating their capacity to’reach’ progressively smaller and lower-quality audiences, is how modern marketers will triumph.”

Similarly, Matt McLeggon, senior VP of advanced solutions at Magnite, stated that while programmatic has begun to demonstrate promise as a model for a television ecosystem that is fully converged, “a significant headwind to efficient monetization has proven to be a scarcity of audience and contextual signals in legacy environments.”

According to McLeggon, “a near-term solution is provided by supply-side audience activation, which is already a growing trend in programmatic.” Programmatic addressable will advance in 2024 thanks to the efforts of media owners and MVPDs (multichannel video programming distributors), who will leverage their supply platforms to activate against rich subscriber and consumer data. This method circumvents the technical and financial complexities associated with inserting the custom identifiers into the bid stream that is sent to DSPs, while still providing programmatic buyers with the targeting precision they are used to in CTV.

READ MORE: Agentio Raises $4.25 Million To Increase The Programmatic Nature Of Paid Creator Content

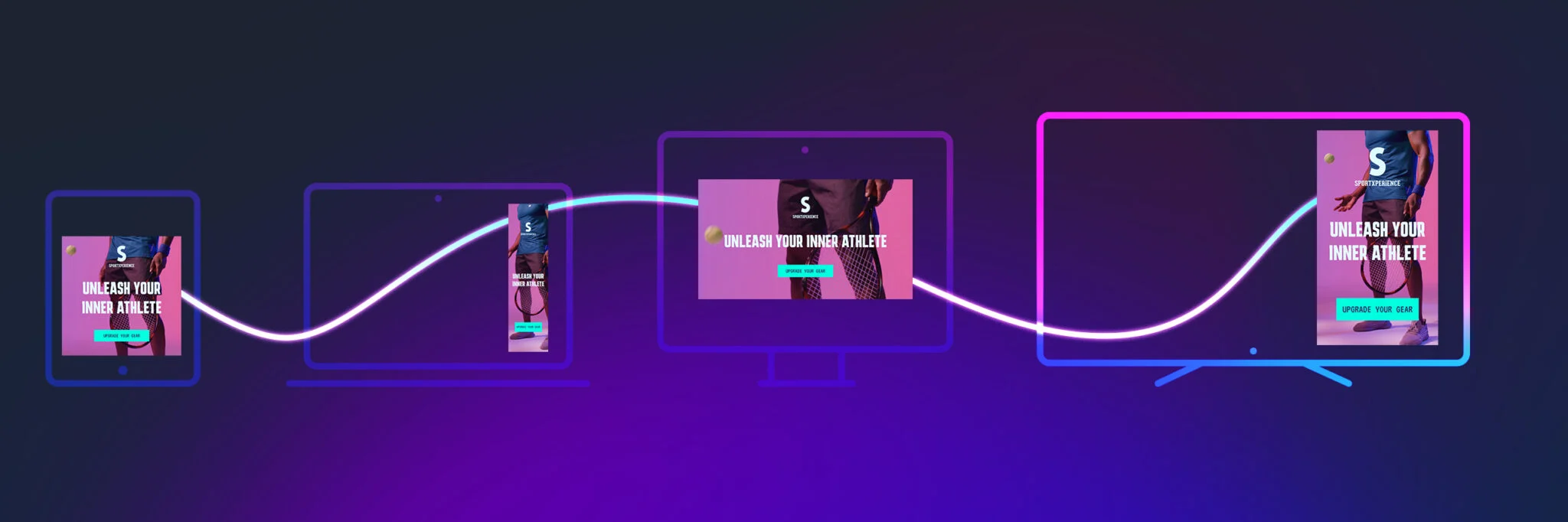

Digital Remedy’s CEO and creator, Mike Seiman, predicted that digital media would dominate TV advertising, with linear TV playing a supporting role.

According to Seiman, “ads will still invest in linear TV, but there will be a significant shift in the expectations of the medium and its place in the larger ad ecosystem.” This is due to the fact that digital TV is becoming essential for both consumers and brands. The medium will have a significantly greater influence on expenditure allocations in 2024 since it naturally gives advertisers more ways to hold spend accountable to ROI than linear can.

Seiman predicts that at the same time, streaming TV will be closely examined.

“The quality of streaming ad inventory will come under the microscope as streaming competition rises and CTV budgets surge,” he stated.

When it comes to audience, attention, engagement, and material quality, Seiman stated, “it is evident that not all CTV inventory is created equal.” As a result, brands will begin to strive for more transparent inventory management and price that accurately reflects quality. Consequently, compared to top-tier CTV, long-tail inventory and web video will be perceived as “less premium,” even though they still have a significant function for brands.

According to DoubleVerify’s chief marketing officer, Dan Slivjanovski, improved measurement is on the way to controlling the uncharted territory of connected television.

“The distinct nature of the environment has presented limitations for CTV advertising since its inception,” he stated. Viewability is a crucial CTV parameter since, for instance, DV research indicates that one-third of CTV impressions serve in contexts that broadcast advertisements and fire impressions long after the TV is turned off.

Slivjanovski predicted that in 2024, the open measurement system will be used more extensively, which will help to resolve the issue.

The capacity to transact on viewable impressions in CTV, which is already a common billable metric on desktop and mobile, is made possible by open measurement, which also provides audio and AVOC measurement, full cross-screen viewability measurement using the same underlying expectations and specifications across CTV, mobile, and desktop environments, and measurement and reporting based on customized viewability standards, according to Slivjanovski.

Attention metrics will also become more significant in CTV at the same time.

Advertisers must assess an ad campaign’s success across all platforms in order to demonstrate that it generated a profit, according to Slivjanovski. However, this has proven difficult on CTV because there aren’t enough KPIs (key performance indicators) accessible to track progress and improve results. Currently, the majority of CTV marketers use cost as a proxy to optimize their campaigns. This is a problem, though, since the majority of advertisers currently buy content directly from publishers or through private marketplaces (PMPs), where the prices are the lowest. Because of this, advertisers have been waiting a long time for a way to measure impact on this channel more accurately.

According to DV study, a mere 30% of CTV advertisements manage to capture two or more seconds of viewers’ attention.

“The development of granular attention measurement for CTV continues to be an industry priority, given the increased demand and overall advancement of CTV viewability measurement technology,” Slivjanovski stated. “DV anticipates that CTV attention measurement will see a rise in adoption and become more widely available in 2024.”

Less convinced about attention is Dan Mouradian, vice president of Innovid’s global client solutions.

READ MORE: How Icelandair Increased Reservations Using Programmatic

Even while discussions about attention metrics are still going strong, whether or not a customer has “paid attention” to a commercial does not determine the efficacy of a campaign. Moreover, in a setting where a lot of money has been spent, these measures shouldn’t be the primary consideration for evaluating CTV performance. According to Mouradian, “we can anticipate that in the coming year, advertisers will realize that there are better ways to measure campaigns, such as interactive advertising that genuinely provide insight to outcomes without question.

Ad servers are changing, according to his colleague Laura Foster, VP of product marketing at Innovid.

According to her, “modern ad servers are similar to iPhones in that users rely on them in the same way that advertisers rely on their data-driven ad servers.” However, to thrive in the current competitive market, an ad server needs to maintain its independence, choosing the best course of action for the client while upholding openness and confidence as an impartial third party.

Given that Amazon intends to shut down its ad server at the end of the following year, we have already seen the value of independence. By 2024, ad servers will be recognized for more than just tracking clicks and impressions—they will be acknowledged as a vital link in the process of converting standard advertising into meaningful content.

According to Tony Marlow, chief marketing officer of LG Ads Solutions, marketers are shifting their spending from cable to CTV.

“We expect a major and sustained shift in advertising dollars from linear TV to connected TV in 2024,” he stated. This alteration is a result of consumers spending more time watching CTV content, which has been the “big shift” over the past few years. Notably, the popularity of free, ad-supported streaming services has grown, providing advertisers with a great opportunity to interact with consumers in their increasingly preferred medium. Additionally, the amount of content that was accessible was increased with the launch of ad-supported streaming choices on well-known websites like Netflix and Disney Plus. In 2024, this transformation is anticipated to pick up speed.

In 2024, Marlow said, CTV will emerge as a revolutionary arena for political advertising.

Marlow stated, “Political campaigns will take advantage of CTV’s addressability to tailor their messages more precisely than ever before.” CTV can target particular demographics, places, and interests. This calculated action not only takes into account how media consumption is evolving, but it also recognizes that younger, tech-savvy voters are more likely to be swayed by content from digital streaming platforms. As a result, CTV advertising will be crucial in forming political narratives since it provides an unparalleled degree of interaction and message personalization in the context of election politics.

According to Michael Scott, vice president of sales and ad operations at Samsung Ads, in 2024 FAST channels will be competitive with AVOD.

According to Scott, the initial goal of the development of numerous free ad-supported TV (FAST) platforms was to provide users with additional options in an increasingly costly streaming ecosystem that relied on subscriptions. “Now, in 2024, we can see that legacy subscription players are reconsidering their approach around premium offerings, indicating that this is a clear preference.”

Fast content is currently available on all major news networks, and live sports is also trending toward fast.

“These platforms are now posing a serious threat to AVOD’s dominance when it comes to content debuts and exclusives,” according to Scott.

Scott went on to say that Samsung Ads anticipates a rise in interest in shoppable ads. According to a recent Samsung study, 50% of viewers who could recall watching one reacted with a shoppable advertisement. Shoppable advertisements also have excellent brand recall.

According to Scott, “when consumers see a product on TV, they want to be able to purchase that product or learn more about it quickly and increase the ease of access along their path to purchase.”

According to Hunter Terry, head of CTV at Lotame, independent streamers will benefit from the expected growth of FAST channels.

With the increasing popularity of ad-supported video offerings from major players like Netflix and Disney, smaller video programmers like Tastemade will seek to increase their market share by using partnerships and scale. Indeed, CTV is beginning to lean toward a small number of winners who control most of the expenditure. In light of those conditions, Terry predicted that a large number of independent content providers will give up on their independent CTV applications and think about shifting their sales to Roku, Amazon, or other FAST networks.

Terry stated, “As a result, it is likely that more advertising funds will go to the platforms rather than the independent publishers.” “Selling tools might be a more profitable endeavor than going gold mining, much like in the gold rush.”

Elizabeth Herbst-Brady, chief revenue officer at Yahoo, forecast a sharp increase in the significance of creativity in advertising.

“Creative will be more important to programmatic success in 2024,” Herbst-Brady said. This is particularly true when the sector struggles with issues related to identity resolution. While we still need to strengthen the foundations pertaining to quality inventory and identity, creativity will be the primary driver of engagement, performance, and brand awareness.

“With the convergence of generative AI, the necessity of managing the cost of creative development, and the addressability of CTV, creative will be top of mind for all advertisers, but particularly so for CTV advertisers,” the spokesperson stated.

Herbst-Brady said, “Advertisers will be empowered by AI to create a multitude of creative variations for their campaigns and to deliver personalisation like never before.” This enables them to interact with viewers in a variety of geographic locations, languages, and viewing settings without having to pay exorbitant production expenses. However, by changing the creative that viewers see in their own homes, it also lessens ad fatigue.

In a similar vein, Field Garthwaite, CEO and co-founder of Iris TV, stated that he thinks improved campaign performance is the result of having the correct creativity and the proper mindset.

“Brands can more effectively target consumers, place ads in the context of content they’re engaging with, and better identify consumers with the help of video-level data,” according to Garthwaite. Customers pay four times greater attention to advertisements that are relevant to the material they are watching, according to research.

He went on, “AI and machine learning offer promising avenues for targeted messaging and ad creative development.” But making sure advertisements reflect the attitudes of the target demographic is a difficulty. As the advertising industry changes, creating high-quality content is no longer as important as reaching customers in the correct mentality. Misalignments can have a detrimental effect on political campaigns by creating a bad perception of a brand.

According to Garthwaite, “more than half of consumers were less interested in the brand and products found in contextually misaligned ads,” according to the AVCA [Alliance for Video-Level Contextual Advertising]. “It’s critical to use not only video-level data but also emotional and AI-driven data to deliver the right ad, in the right context, and right mindset of the consumer for brands looking to better increase campaign performance in 2024.”

Radiant and America Nu, offering to elevate your entertainment game! Movies, TV series, exclusive interviews, music, and more—download now on various devices, including iPhones, Androids, smart TVs, Apple TV, Fire Stick, and more.