Introducing CTV OOH, the newest abbreviation in ad tech (connected TV out of house).

This week, Taiv, an out-of-home advertising technology platform, and Nexxen (formerly Tremor International) announced an integration that will allow Taiv to expand its CTV ad campaigns to TV screens in sports bars and restaurants. When it comes to leveraging TV to reach as many people as possible, guess what’s old is new again?

According to John Rogers, vice president of worldwide business development at Nexxen, CTV OOH can “provide additional scale to traditional CTV campaigns.” OOH inventory is typically not heavily invested in by brands that value one-to-one targeting over reach, though sufficient volume may persuade some advertisers to change their minds.

READ MORE: Users Demand More Privacy Online, While Ad Tech Is Driving The Opposite

Advertisers and venues are Taiv’s two clientele.

The business installs hardware for TVs that are installed in restaurants and pubs. In order to replace a scheduled commercial break with its own advertisements, this technology employs artificial intelligence (AI) to recognize when a commercial break begins and switches the active TV input from the program playing to Taiv’s device.

Because they receive a portion of the ad revenue—which represents net-new cash for many brick and mortar establishments—venues consent to this arrangement. Perhaps more significantly, though, is that these areas can also rotate their own house advertisements.

READ MORE: Ad Tech Companies Are Being Assessed Based On How Open They Are With Their Log Files

Consider the Irish Pub Mickey Byrne’s in Hollywood, Florida. According to the bar’s owner, Mark Rowe, advertising for its own events—like karaoke nights and happy hours—is increasing foot traffic and revenue. Posters, personalized beer coasters, and other more conventional methods of promoting these offers are not as successful as the advertisements.

This is because, in Rowe’s words, “chances are, they’re staring at the TV screen” when customers enter a bar that has a TV. (A cunning sales tactic, yet depressing given the status of social interactions.)

Advertiser buy-in is usually a challenge for CTV OOH ad tech businesses, despite their advantages.

According to Taiv’s chief revenue officer, Tony Siconolfi, CTV OOH is currently in its “infancy phase.” Additionally, he noted that agencies “don’t typically jump” at the chance to test new ideas until they are convinced that they would be successful.

READ MORE: Nine More States Have Joined The DOJ’s Case Against Google’s Alleged Antitrust Ad Technology

Through private marketplace agreements, Nexxen is providing its clients with Taiv’s CTV OOH supply.

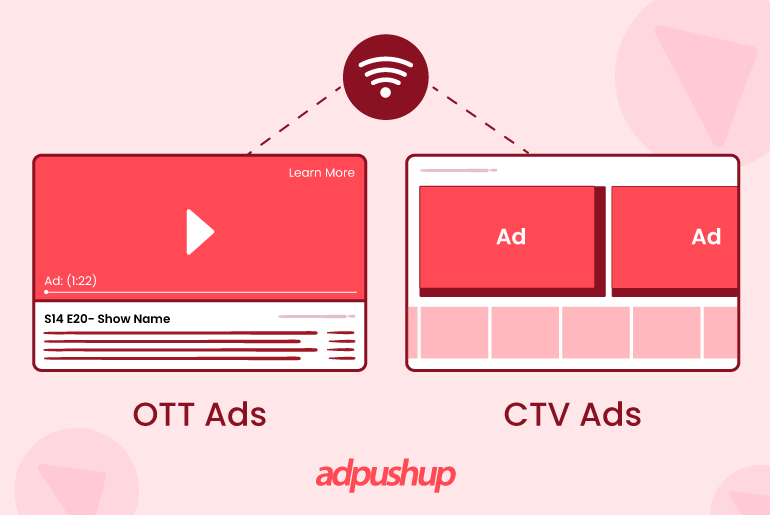

Programmatically speaking, Nexxen’s execution is comparable to CTV since it does not employ an impression multiplier, which is a method typically employed by out-of-home advertising technology businesses to estimate the likelihood that a given advertisement was seen by a public audience. Rogers clarified.

Even though it’s a more difficult sale, Nexxen brands this inventory as CTV OOH (rather than just CTV) to ensure that marketers truly understand what they’re buying. Public TV ad inventory is frequently combined with traditional CTV supply, leading advertisers to purchase more of it—albeit unintentionally. Describe it as the “sorta CTV” thing.

Because OOH ad delivery is one-to-many, targeting is more constrained than with traditional CTV. In this scenario, advertisers are able to target CTV OOH advertising according to content type (like sports or entertainment) and broad geolocation (like ZIP code or defined market area).

READ MORE: The ‘Death Of The Undifferentiated SSP’ Is Not Affecting Every Ad Tech Company

However, restricted targeting may provide a benefit for purchasers. The cost of the ads is far less than that of premium TV inventory. According to Siconolfi, Taiv’s CPMs often range from $15 to $20, and advertisers frequently spend more than twice that amount to advertise on live sports.

In addition, CTV OOH advertisements can be more regionally focused thanks to geotargeting than national sports broadcasts or livestreams, for example, catering to companies in certain states.

According to Siconolfi, a large portion of Taiv’s brand customers are from industries like consumer packaged goods, alcoholic beverages, fast food, travel, and autos that frequently run advertisements during live sporting events. Among the clients are Verizon, Taco Bell, PepsiCo, and Liquid I.V.

Advertisers looking to reach a broad audience with some basic targeting should choose CTV OOH. However, for firms like direct-to-consumer businesses whose success depends on solid one-to-one relationships, it might not be an obvious solution.

What comes next?

Taiv anticipates attracting more brands who want to extend their reach for their streaming ad campaigns, even though it’s still too early to tell how this integration is working for Nexxen advertisers.

Next year, Taiv intends to open more locations, including stores.

Compared to when the bar first used Taiv’s technology before the Nexxen integration, Mickey Byrne’s is seeing more advertisements from major national businesses play, as is also apparent from the larger rev-share checks that are being received, according to Rowe.

which makes sense.

According to Rogers, more marketers will begin purchasing CTV OOH the larger the size.

Radiant and America Nu, offering to elevate your entertainment game! Movies, TV series, exclusive interviews, music, and more—download now on various devices, including iPhones, Androids, smart TVs, Apple TV, Fire Stick, and more.