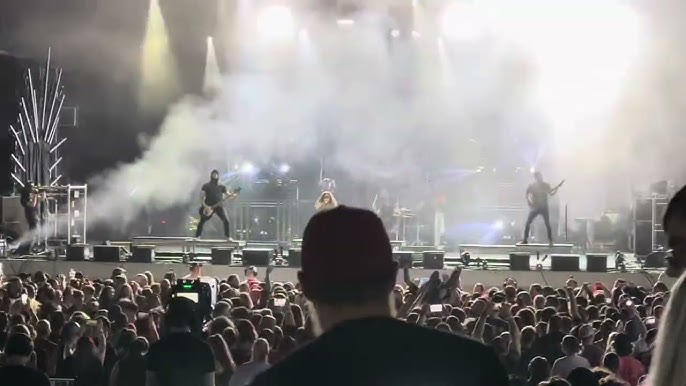

According to a recent analysis by Bank of America researchers, live music will fuel “funflation” even as other consumer spending declines.

A recent report by Bank of America’s Global Research Analysts predicts that live music and related events will continue to fuel the post-pandemic boom in consumer spending, even as other consumer purchasing becomes more frugal.

While many economists fear that consumers will spend their “pandemic savings and delayed student loan repayments” resume for core concertgoers, resulting in a major decline in discretionary spending, Bank of America’s analysts predict a different story for the live music industry.

Writers Jessica Reif Ehrlich, Peter Henderson, David Plaus, and Brent Navon, CFA of BofA Global Research Analysts state that “live entertainment is currently the brightest star in the broader media and entertainment universe.” “In our opinion, a number of long-term, sustainable major drivers will support strong growth for a number of years.”

The post-pandemic live music boom will primarily be driven by the younger millennial and Gen Z generations, whose spending is primarily shifting toward experiences and services. Strong pricing power will also contribute to the rising demand for live music.

According to the research, live events are “disruption-proof,” as virtual and live-streamed events “fail to deliver” a comparable experience. Other factors mentioned include the rise in sponsorships and experiential marketing, as well as the increased worldwide fan awareness resulting from social media.

The investigation reveals that iHeartMedia, Endeavor Group Holdings (previously William Morris Endeavor), Warner Music Group (WMG), Spotify, and Madison Square Garden Entertainment (MSGE) are among the businesses that are directly and indirectly exposed to live music events. The analysts believe that these companies will profit from live touring talent’s overall revenue growth, which will help to somewhat offset the challenges posed by the ongoing strikes by the actors’ and writers’ guilds in their respective TV/movie rep businesses.

“Strong touring drives fan engagement with artists, which in turn drives increased merchandising sales, digital streaming revenues, and album sales of these artists,” the research states for WMG and the larger music labels. “Spotify’s relationship with the concert industry creates a positive feedback loop since fan interaction not only boosts MAUs but also encourages people to discover new music, which in turn increases attendance at concerts. Attending concerts increases music-related consumer engagement overall, which retains people on streaming services.

“Owning a growth-oriented, pure-play live entertainment company with a strong collection of venues in the world’s largest concert market is made possible by MSGE.”

The survey also notes that bigger organizations and venues have a distinct edge in the live events industry. According to the report, vertical integration and scale are competitive benefits in the live events industry, but they also come with a price tag that includes substantial infrastructure and start-up costs in addition to funding working capital and other production needs.

“Live Nation has the balance sheet and other potentially profitable events that can soften this impact if one or two of its shows don’t work out. However, smaller organizers might not have the volume of events to make up for a single significant loss or the financial stability to survive an unsuccessful event production.

Because it allows “larger providers to offer more competitive pricing and even utilize certain business segments as loss-leaders,” they clarify that “vertical integration across the value chain is another means to enhance competitive positioning.” This is because they know they can recoup these values elsewhere in the value chain.

The report concludes that the live event industry has been driven by so-called “funflation” and ticket price increases since the pandemic. It estimates that dynamic pricing will provide additional support for ticket price growth and will continue to drive a “increased wallet share of economics” toward the artists.

Download The Radiant App To Start Watching!

Web: Watch Now

LGTV™: Download

ROKU™: Download

XBox™: Download

Samsung TV™: Download

Amazon Fire TV™: Download

Android TV™: Download