The NFL’s streaming business may be traced back to a party at Bill Gates’ residence outside of Seattle a few years ago.

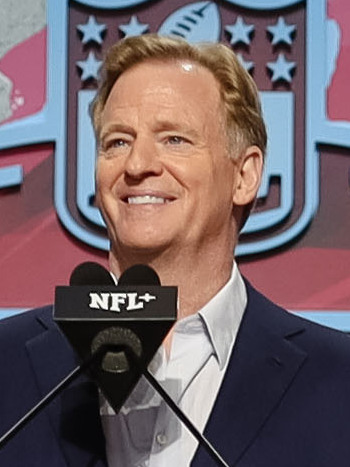

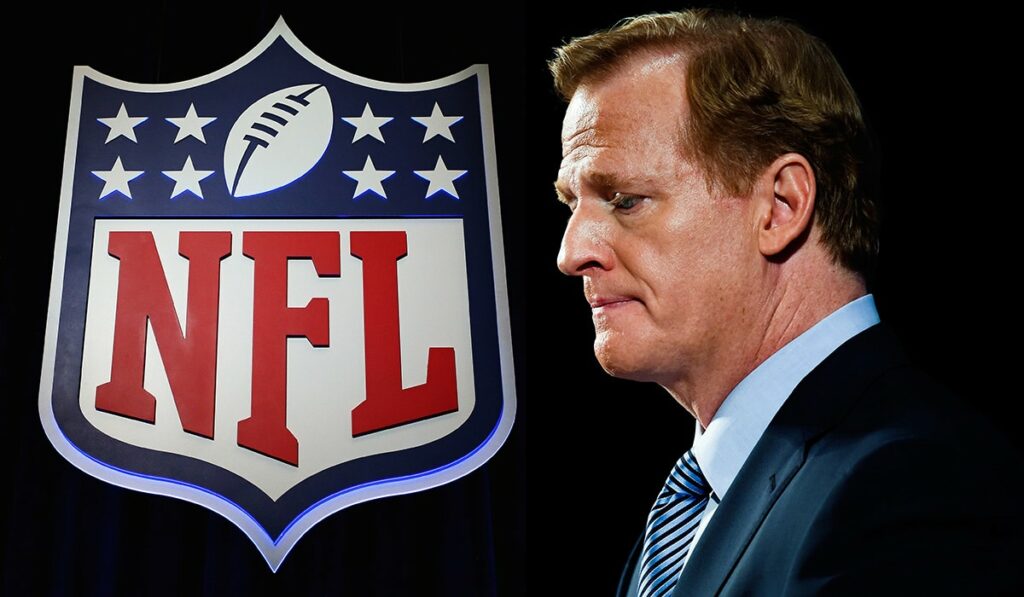

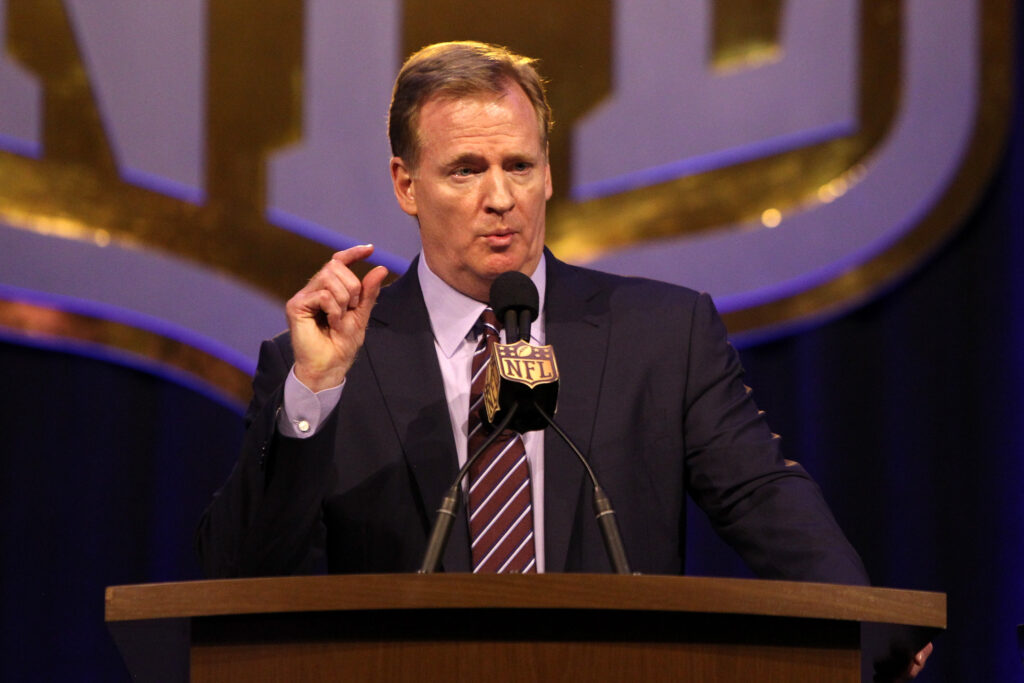

The event coincided with a Microsoft gathering, and NFL Commissioner Roger Goodell recalled speaking with Amazon founder Jeff Bezos there. “I was just talking about our content and what it could do for their technology,” Goodell says, adding that he believes the NFL can assist Amazon in expanding its advertising business and Prime Video subscription service. “I distinctly remember him wearing sunglasses and putting them on the end of his nose,” Goodell continues. “‘And now you have got my attention,’ he said.”

Amazon would go on to sign an agreement to simulcast Thursday Night Football games beginning in 2017 and eventually take over the package entirely last season. When it was inked in 2021, it was the most significant gamble by a major sports league on streaming, and it provided a glimpse into the league’s future.

However, Amazon’s entry into the NFL industry in 2017 came at a difficult time for the league, to say the least. Consider how pro football and concussions became a national subject after the 2013 documentary and book League of Denial argued that the NFL ignored accumulating evidence of a medical, public relations, and legal problem. That year, the NFL paid $765 million to settle a lawsuit brought by former players over concussion-related brain ailments.

The NFL then became embroiled in the Trump era culture wars, with players (most notably Colin Kaepernick) kneeling during the national anthem to protest police brutality. As a result, the president chastised the league and its players, branding them unpatriotic. (In 2017, Kaepernick opted out of his contract with the San Francisco 49ers and would never play in another NFL game again; he settled a grievance action against the league in 2019 after alleging collusion kept him off the field.)

It was an awkward situation for the NFL, as well as for Goodell, who had been the league’s commissioner since 2006. “We have always prided ourselves on the fact that this is one of the last things in a fractured country that people can get around and enjoy together,” says Brian Rolapp, the league’s chief communications and business officer.

The NFL responded by implementing stricter concussion protocols, as well as new equipment (like as helmets) designed to reduce the dangers. It has also leaned on flag football to make the game more accessible, even changing the format of the Pro Bowl this year to conclude in a flag football game in response to injury concerns in the all-star event.

While still a TV powerhouse, the league’s viewership decreased by 8% during the 2016-2017 season, and another 9% the following season, drawing scrutiny from journalists and Wall Street analysts concerned about the impact on media companies. Ratings began to improve in the 2018 season, but concerns about cord-cutting and the shifting media economy influenced the league’s media strategy.

A delegation of senior NFL officials, including Goodell and Rolapp, met with top YouTube executives in March 2020 at the company’s headquarters in San Bruno, California. For years, league executives have traveled to Silicon Valley to stay up with the latest technology and maintain contact with the industry’s key players. “We have always felt it was our responsibility to go learn from the best and the people at the center of that,” Goodell says of the regular trips. “[It was] one of those meetings that we like to do on a regular basis to check in on each other’s businesses,” YouTube CEO Neal Mohan recalls.

The NFL was planning its next round of TV licensing negotiations, and executives anticipated that a tech behemoth would be interested in joining forces. TNF games were simulcast on Amazon and some linear channels, but the league had yet to sell a live games package specifically for streaming at the time.

By the time the NFL contingent arrived in New York a few days later, the globe had shut down due to COVID-19, which had drastically altered the media environment. Cord-cutting accelerated, and millions of people rushed to streaming services. According to Rolapp, it was a “seminal moment” in how the league conducted its media partnerships.

Exclusive live games were awarded to current partners NBCUniversal, Disney/ESPN, Paramount, Fox, and, in a first for a tech business, Amazon in May 2021. What is the total worth of the rights over the length of 11 years? $110 billion, the biggest set of pro sports contracts in history. A year and a half later, in December 2022, YouTube would join the fray, acquiring the rights to the NFL’s out-of-market Sunday Ticket package for an estimated $2 billion per year.

“Technology is evolving. Platforms are evolving. The economy is evolving. “We have to stay ahead of that strategy at all times to be where our fans are, on the platforms they want to be on,” Goodell said of the rights negotiations.

It helps that the NFL has re-established itself as the dominant power on live television. According to Nielsen, 88 of the top 100 most watched TV broadcasts in 2022 were NFL games, including 23 of the top 25. The league can amass eyes in a way that no one else on TV can, making it a valuable commodity for its rights partners looking to offer that scale to their marketing clients.

That reach is one of the main reasons why the NFL has been able to command rights prices that are unprecedented in their extent and magnitude. (By comparison, the NBA is nearing the end of a $24 billion rights deal signed in 2014 with Disney and Turner that runs through the 2024-25 season.) “The media [deals] are our main source of revenue,” says Robert Kraft, owner of the New England Patriots and chairman of the league’s media committee. “We are always thinking long-term and strategically, making sure we are doing the right thing for our players and presenting in a way that our fans want to stay connected to it.”

Cord-cutting has taken its toll — about 100 million pay TV subscribers in 2015 have dwindled to about 77 million this year, according to a Wells Fargo tally — but Fox delivered the most watched regular-season game in NFL history, with the Dallas Cowboys defeating the New York Giants on Thanksgiving Day, drawing more than 42 million viewers, and the most watched Super Bowl, with the Kansas City Chiefs defeating the Philadelphia Eagles drawing more than 115 million viewers. Pay TV may be in decline, but the NFL is not. According to Goodell, the league is “essential to building an ad-supported platform.”

Typically, television’s upfront week in May is full with spectacle and flare. Media buyers and advertisers make their way from one midtown Manhattan venue to the next, while big media businesses strive to impress them with sizzle reels, celebrities, and musical performances.

The WGA strike, which began only days before the upfronts on May 18, threw a wrench in those plans, leaving networks unsure of when shows will launch and stars missing the festivities in solidarity. Because of the uncertainty, the NFL was the primary throughline for the upfronts. Every network that has a partnership with the league made certain that media buyers were aware of it. While striking writers marched outside the Manhattan Ballroom on 34th Street, Fox finished its event by having NFL on Fox contributors Michael Strahan and Rob Gronkowski stand on a bar in the middle of the room and hurl signed footballs into the crowd.

Disney’s upfront, held in a massive facility at the Jacob Javits Convention Center, made do without actors by relying on NFL and sports stars, including ESPN2 Manningcast presenter Peyton Manning and Serena Williams. However, it was the Monday Night Football duo of Joe Buck and Troy Aikman who received the only standing ovation of the week when they brought out Buffalo Bills safety Damar Hamlin, whose terrifying collapse on the field in Cincinnati four months earlier was chronicled live on their broadcast and sparked yet another debate about the game’s safety (Hamlin was revived by on-field medical staff, who are credited with saving his life).

At Disney’s afterparty, which was hosted in a similarly large room upstairs, Hamlin, Buck, and Aikman held court in front of floor-to-ceiling windows overlooking the Hudson River, with a line of people 30-deep waiting to speak with them.

With the television industry in limbo, the NFL has stepped in to fill the void. And, according to Goodell, the actor and writer strikes may lead to its TV partners leaning even more on NFL programming due to a lack of scripted content and a need to keep ad dollars flowing. “NFL content is the best reality television there is,” he says. “I know people say I script the season, but I don’t.” “There will be opportunities during this time period, which is unfortunate, but it exists, and I believe our content will have more opportunities during this fall season.” It is dependable material, and it is dependable in terms of advertising.”

While the NFL’s collaborations with Disney, Fox, Paramount, NBCUniversal, YouTube, and Amazon are obviously lucrative, Rolapp argues that they are also a “give-and-take.” Of course, the league wants the rights revenue, but it also wants reach. Meanwhile, the partners have their own interests, such as selling advertisements against NFL content for top pay. “We are attempting to unleash all of that innovation in order to improve the NFL and our partners,” Goodell said.

The scheduling is still the most contentious issue between the league and its partners. With a limited number of games available (the NFL has a 17-game season, compared to 82 for the NBA and NHL and 162 for Major League Baseball), the league attempts to distribute the best matchups among its partners. Early in the season, every channel seeks exciting matches, but later in the season, they seek games with playoff significance. The inclusion of “flex” scheduling, which pushes a game from Sunday afternoon to primetime late in the season, has been one remedy. NBC’s Sunday Night Football originally acquired the rights in 2006, followed by ESPN last year and Amazon next year.

veteran commissioner Pete Rozelle, a veteran public relations executive who ran the league from 1960 to 1989, helped to shape the league’s focus on reach. “At the time, the NFL was far from the most popular sport in this country; college football, baseball, horse racing, boxing, and other sports were more popular,” Rolapp explains. “And I think a lot of it was [Rozelle] saw television and reach as a way to build a sport.” Part of that endeavor included dividing regional AFC and NFC rights among networks and adding primetime national games like those on Monday evenings.

The outcome is visible in its rights: the vast majority of games are available on broadcast television (at least in local markets), allowing them to reach as many TV households as possible. Even ESPN, the NFL’s long-time cable TV partner, is increasing the number of simulcasts on ABC, while Paramount has created Nickelodeon versions of games with kid-friendly announcers, CG slime, and special effects for family viewing — there will even be one for the Super Bowl this year — and Amazon is preparing its first “Black Friday” game. “It is an opportunity to create a new sports holiday where there is football, shopping, and family,” says Marie Donoghue, Amazon’s VP of US sports content and partnerships. “There will be some new innovations and other entertainment surrounding the game.”

In contrast, the NBA has exclusively licensed its rights to Warner Bros. Discovery and Disney/ESPN, which limit national games to one broadcast network; and MLB, which has Fox Sports and WBD as key partners (again, only one broadcast network), and has also sold off packages to Apple and Peacock, making some games difficult to locate.

“The NFL has done a very good job of trying to extend rather than replace,” says LightShed Partners analyst Rich Greenfield. Every media organization must prioritize the reach of their content. Nobody has done a better job of broadening reach than the NFL.”

Acutely aware of the issues that linear TV faces, the league is also attempting to assist its partners in making their streaming companies a success. “From a media standpoint, the scene is shifting. “Our shifting partners are increasingly looking for streaming alternatives,” Goodell adds.

This implies simulcasts on Peacock, Paramount+, and ESPN+, but with the new rights arrangements, they also get the ultimate prize: exclusive games, a big contract to reach streaming viewers outside of local regions. Amazon has paved the path in many ways.

“That was our main concern: could you handle that many people at once?””With regard to the Amazon deal,” Goodell says. “That is always an issue with these platforms.” And, thankfully, they have all invested significantly and demonstrated their ability to do so.” Streaming technology was an unclear risk a few years ago, but it is now a safer option (as it happens, Amazon Web Services already works with all of the NFL’s media partners).

“I do not think I could see us taking all of our playoffs and putting them on a digital platform,” Rolapp continues. “However, making real commitments with valuable inventory we thought was a good way to go.” “We want NBC to succeed with Peacock because it advances our reach thesis, and them having a successful legacy television business as well as a digital business is in our best interests.”

In the case of Peacock’s games (including a Wild Card game, the first playoff game unique to streaming), officials are careful to point up that the games will also appear on the local NBC station in the individual teams’ home markets. The Peacock games will be the second half of a doubleheader for both exclusives, with NBC leveraging its broadcast opener to encourage people to streaming for the game that follows.

“Being a very progressive media company — as the NFL is and as we are — we had a lot of things in common that we were trying to solve,” says NBCU media group head Mark Lazarus. “We truly believed that driving an NFL audience from one game to the next across another platform would benefit us and help prove the value of streaming to the NFL.”

Last year, ESPN+ hosted its first unique NFL game from London, and it will have another this season. “The idea here is just to keep focusing on how we can expand the audience, how we can broaden the scope of where NFL games are available, how we can create this rising tide of fandom,” says ESPN chairman Jimmy Pitaro. “We want to deliver for the ESPN+ platform as a priority, but we also want to deliver for the NFL here.”

Pitaro points out that Manningcast’s average watcher (48) is five years younger than those watching the main broadcast (53). As it happens, the Peyton and Eli Manning production may be traced back to the pandemic. Pitaro recalls, “We had some of our analysts covering games from home, from their basements.” “And Peyton Manning called me and said, ‘Hey, is this something you think I could do in the NFL?'”‘And I said yes right away.”

On May 17, three years after that meeting in San Bruno, Goodell came onto the stage alongside YouTube creator Deestroying (real name: Donald De La Haye) to promote the site as the new home for Sunday Ticket. “It is been a partnership and relationship that has been years in the making,” Mohan adds, noting that Sunday Ticket was not discussed at the fateful March 2020 meeting.

Goodell claims that the potential of YouTube bidding for Sunday Ticket was addressed at the Allen & Co. conference in Sun Valley, at playoff games, and at Google’s Zeitgeist conference over the years. It culminated in the league’s decision to embrace the creative economy during YouTube’s Brandcast event at Lincoln Center.

MrBeast (real name: Jimmy Donaldson) promised that the partnership would mark “a whole new era for NFL content on YouTube,” owing to the expanded access the league will give creators. Goodell’s segment onstage ended in a show of force only YouTube could deliver, with the commissioner handing off to arguably the platform’s most successful content creator: MrBeast (real name: Jimmy Donaldson). MrBeast announced a promotion in collaboration with the league on August 25th, giving away Sunday Ticket subscriptions and a ticket to the 2024 Super Bowl in Las Vegas.

“That is the power of YouTube that the NFL, to their credit, recognized, especially for young fans all over the country and, frankly, all over the world,” Mohan says, adding that creators of lifestyle, food, and gaming video, as well as sports content channels, have sought out. “Creators will have access to game-day content — you can imagine them producing shoulder content, so not just what is on the field but what is going on behind the scenes.”

Goodell comments that the YouTube talent brings “another way of looking at the NFL” as well as “extraordinary reach with their followers.”

The heart of YouTube’s new NFL arrangement is Sunday Ticket and its expanded availability, but it is also a bet on the future of football consumption and advertising.

During a previous business trip to Silicon Valley in mid-2007, NFL executives gathered at Apple Inc.’s Cupertino facility. The iPhone, the company’s most recent innovation, had just been released. The executives, including Goodell, met with Apple CEO Steve Jobs, who urged them to install Wi-Fi in their stadiums. “That seems so mundane now, but it was expensive,” Rolapp says, adding that Jobs promised them that his latest innovation would alter the world: “Mobile connectivity will not be optional, everybody will expect it, and it will be ubiquitous.”

Sixteen years later, the league is counting on the now-ubiquitous technology that Jobs unleashed to develop a billion-dollar business. And, yes, Wi-Fi is available in all stadiums.

The NFL announced on August 10 that it would introduce its pay TV channels, NFL Network and RedZone, to its direct-to-consumer streaming service, NFL+. NFL+, which will be available in 2022, previously included live audio from all NFL games as well as live video from local games on the iPhone and other mobile devices.

With the addition of NFL Network and RedZone (on any device), the sports channels are now available without a pay TV subscription for the first time, for a monthly fee ranging from $6.99 to $14.99. It is not a modest wager. According to Nielsen, NFL Network is in more than 51 million homes and makes more than $2 per subscriber, ranking second only to ESPN among sports networks.

The league is jeopardizing more than $1.2 billion in annual revenue from cable carriage fees. Pay TV prices are not going away suddenly, but with cord-cutting increasing year after year, the value of those fees – for every channel — is decreasing as well.

Goodell says the league had been considering the move for “several years,” but it was not until last summer that the organization cleared enough distribution deals to go direct with its NFL Network. “Our model tries to thread the needle of being really strong and maintaining that presence on pay TV while expanding access beyond,” says Hans Schroeder, executive vice president and COO of NFL Media.

“It is definitely a DNA shift,” says David Jurenka, senior vp at NFL Media, adding that NFL+ customers are 10 to 15 years younger than those who watch the network on conventional TV. According to Jurenka, the service already has “millions” of customers, and NFL Network and RedZone are sure to add to that number.

NFL+ is a portal to the future for the league, a gathering place for the next generation of NFL fans, with the organization able to take the risk of establishing it thanks to those huge media rights deals. It is also a disruptive change in business models, and everyone in the pay TV ecosystem is watching.

The direct-to-consumer campaign emphasizes the league’s ambition to be everywhere, as well as to have more control over its programming. As a result, there is an expanding landscape of NFL Films projects on platforms such as Netflix (where Quarterback, which followed three quarterbacks, including Chiefs star Patrick Mahomes, during the 2022-23 season, debuted at No. 1 in July) and the Roku Channel, where it debuted a behind-the-scenes look at the NFL Draft on Aug. 25 (the draft show was renewed Aug. 28).

Sure, it is a wager on the burgeoning business of sports documentaries, but it is also an opportunity to shape impressions of the league and its players, with the tightly edited documentaries and docuseries blanketing streaming services based on (mainly) league-approved drama. It is a tactic that can be traced back to HBO’s Hard Knocks, which launched in 2001 with “just us and I think Survivor and The Real World,” according to Ross Ketover, senior executive at NFL Films.

Getting a glimpse into the personal lives of players helps to improve their own — and the league’s — image. (It helps that among the characters advertised are the likes of Mahomes, drama-free and a two-time Super Bowl champion). It also appeals to folks who may not be as interested in the games. “We are trying to get as many people as possible into that ecosystem and NFL fandom, and nongame content is a very effective way to do that,” Goodell says. “Intriguingly, Hard Knocks has always done incredibly well with women because I believe they like to see the story, they like to see the struggle, they like to see the challenges, they like to see where these players came from, and they like to get to know them on a more personal level.”

Hollywood is all too familiar with the concepts of storytelling and brand creation. Of course, this does not imply that everything always goes as planned. On the golf course at the American Century Championship on July 12, current York Jets quarterback Aaron Rodgers expressed disappointment that his squad had been chosen for the current season of Hard Knocks.

“They shoved it down our throats, and we have to deal with it,” said the quarterback, adding that he understood why they were chosen. “Obviously, there are a lot of eyes on me, a lot of eyes on our team, a lot of expectations for our squad,” Rodgers said of Hard Knocks. “The only thing I like about it is the voice of God, the man who narrates it, Liev [Schreiber].”

That posed a difficulty to the NFL Films team. “We helicoptered [Schreiber] in, and they spent some time together,” Ketover explains. “You know, if Aaron’s going to cooperate with us, we would like to help him realize some of his dreams as well.”

That ambition to help control the narrative and establish a year-round multimedia business influenced the league’s decision to collaborate with Skydance Sports on a new studio venture, which started late last year.

Following the success of ESPN’s The Last Dance, it appears that every athlete and league wants a piece of the action, including the power to help shape their own narratives.

“We want creatives and players from across the industry to say, ‘Well, I can go out and shop it and try to find a partner, or I can go to the place that really knows how to get this stuff made and sold,'” Ketover adds. “I believe having a Skydance partner with those connections, particularly through Hollywood, opens a lot more doors.”

“Let us collaborate with a company that excels at that, and then we can own the IP and control the message,” he adds.

The JV is still in its early stages, but Ketover says the goal is to mix documentary projects (20 to 30 per year) with films and TV series, mentioning prospective projects such as a written feature about Vince Lombardi and kids’ TV shows.

“I feel like we have been getting random submissions for a National Football League series history for years,” Ketover says. “Well, we can now hire the right producers, screenwriters, and directors to do that.”

The NFL’s ubiquity and reach strategy, along with a desire to help bring the TV industry into the streaming future, has echoes of its past. For league executives, the current state of play is strikingly similar to the late 1980s, when the league saw the rise of cable TV and cut deals for live games on ESPN and later TNT, bringing in new bidders, and when it partnered with Rupert Murdoch to expand the U.S. media market with Fox, which built its broadcast business on sports rights deals and expanded to cable news.

“We were a big part of the growth of broadcast TV — it was a win-win situation.” We reached a much larger audience, which helped them grow to the point where we formed a fourth network with Fox in the early 1990s. “And it was not just a sports network; it was a network,” Goodell explains. “Now it is streaming, and I think a big part of that is advertising, subscriptions, and dual revenue streams, which is what we are seeing here.”

Now, as previously, broadcast television serves as the foundation of the distribution strategy. However, streaming is the new emerging force, and with it, new opportunities, such as Amazon’s debut of tailored advertising in NFL games for the first time this year, or YouTube’s creator push. “Clearly, that is where a lot of the growth is coming from,” says Schroeder, stressing that the league wants to be in both areas. “I believe that everyone has a good crystal ball, but no one has a perfect one.”

But, just as cable bundled all sports and entertainment in one location, league executives are already wondering if a similar reckoning is on the way for streaming. “As a consumer, I might pay a premium if you could just make it easier.” And I am not sure if it will be ESPN, or if Apple will find out a presentation layer that everyone will love,” Rolapp says. “I believe that at some point, the consumer will demand it, and not everyone who distributes directly to consumer over the top will survive.”

In this unpredictable environment, the league aims to bring as many partners as possible along for the voyage. When asked if other leagues will follow the NFL’s stance, Goodell answers, “I think the NFL has taken a leadership position.” “It all comes back to partnering with the best in class, aligning our interests, and unleashing not just the technology, but the power of these platforms, as well as the opportunity to engage our fans more deeply.”

It is a media approach born on insecurity. Uncertainty about what will happen to the lucrative pay TV market, uncertainty about which partners will survive and grow over the next decade, and doubt about the platforms on which football fans will consume the majority of their information.

To remain at the top of the sports world, the NFL must remain relevant, present, and accessible to customers, both current fans and the future generation who have not been exposed to it yet.

“We stole the Andy Grove quote,” Rolapp says, referring to the league’s unofficial mantra. Grove, the former Intel CEO, laid forth his premise for developing a sustainable firm in his 1996 book about leadership: “Success breeds complacency.” Failure creates complacency. Only the paranoid make it.”

“Our real goal is to have football always remain paramount in the nation’s psyche,” says Patriots owner Robert Kraft.

Download The Radiant App To Start Watching!

Web: Watch Now

LGTV™: Download

ROKU™: Download

XBox™: Download

Samsung TV™: Download

Amazon Fire TV™: Download

Android TV™: Download