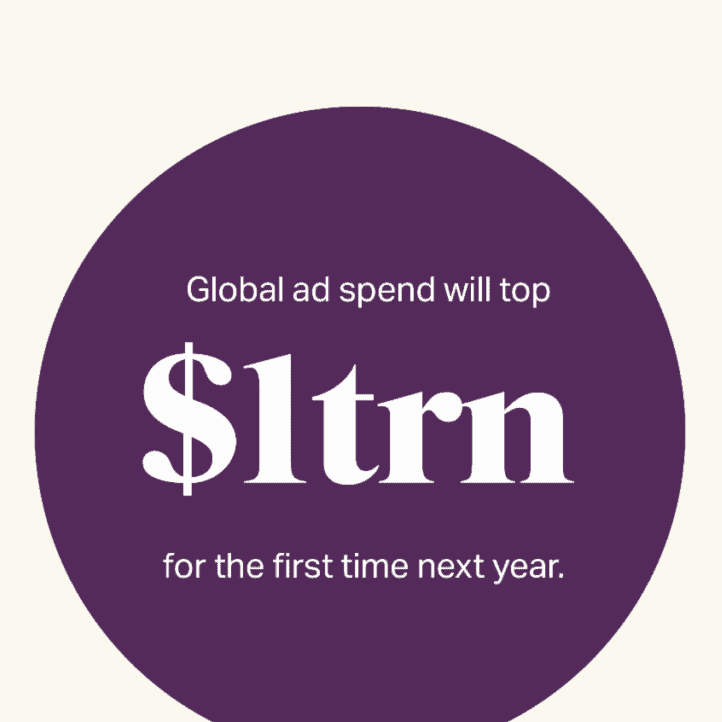

Lingering macroeconomic concerns will not be able to hold back ad spending in 2024, despite a confluence of attention-grabbing events such as the US Presidential election, the Olympics, and the UEFA Men’s Euros tournament.

When that is combined with improving trading conditions, particularly in China, the industry could be in for some record-breaking years.

“High interest rates, spiraling inflation, military conflict, and natural disasters have made for a bitter cocktail over the previous 12 months,” said James McDonald, WARC’s director of data, intelligence, and forecasting, in a release.

“With the establishment of retail media as an effective advertising channel, the advent of connected TV as the next evolution of conventional video consumption, and the continued growth of social media and search, we are seeing once again the value advertisers place in leveraging first-party data to target the right message to the right person at the right time,” McDonald added.

According to WARC, social media will account for $227.2 billion in ad spending in 2024, accounting for more than a fifth (21.8%) of total spend. Meta, which owns Facebook, Instagram, and Whatsapp and dominates over two-thirds of the social media market, can expect to collect more than $146 billion in ad income, followed by TikTok owner ByteDance, which will see little less than $40 billion (equating to a 17.6% share).

Similarly, retail media will grow, with channel spending anticipated to increase 10.2% in 2023 and 10.5% in 2024. Retail media will account for 13.6% of overall ad spending in 2024, totaling $141.7 billion. Amazon is predicted to dominate the channel, accounting for 37.2% of total retail media spending (about $52.7 billion). Meanwhile, in an increasingly competitive Chinese market, Alibaba will lose territory to Pindoudou (14.4% of global retail media expenditure in 2024), JD.com (9.9%), and Meitaun (3.7%).

CTV is predicted to expand 11.4% in 2023 and 12.1% in 2024, hitting $33 billion in total. While this represents only 3.2% of total spending, it accounts for 16.2% of total CTV and linear TV spending. According to the study, media owners of both linear and connected TV will compete for existing TV expenditures rather than taking share from other channels. As a result, linear TV spending is expected to fall 5.4% by 2023. However, political and sporting events should reenergize the category, causing it to expand 3.5% by 2024. Regardless, linear television remains the world’s third-largest advertising medium, accounting for 15.6% of total worldwide advertising spending in 2024.

Search will continue to be the second-largest advertising channel, growing to $229.2 billion in 2024, accounting for 22% of all advertising spending. Despite signs that it is losing market share, Google will control 83.1% of the search industry in 2024, generating $190.5 billion in ad revenue. Baidyu’s portion of the search market will fall to 6.5%, while Bing’s share will remain around 6%.

Financial services will be the fastest expanding sector, with an 11.5% increase, followed by technology and electronics (+11.3%) and pharma and healthcare (+11%). Food, household & domestic, tobacco, and soft drinks are among the CPG categories that will witness growth through 2024, with a higher emphasis on retail media channels.

Download The Radiant App To Start Watching!

Web: Watch Now

LGTV™: Download

ROKU™: Download

XBox™: Download

Samsung TV™: Download

Amazon Fire TV™: Download

Android TV™: Download