AMC Entertainment performed a 1-for-10 reverse stock split this morning, a scheduled move prior to the conversion of its preferred “APE” shares into common stock on Friday.

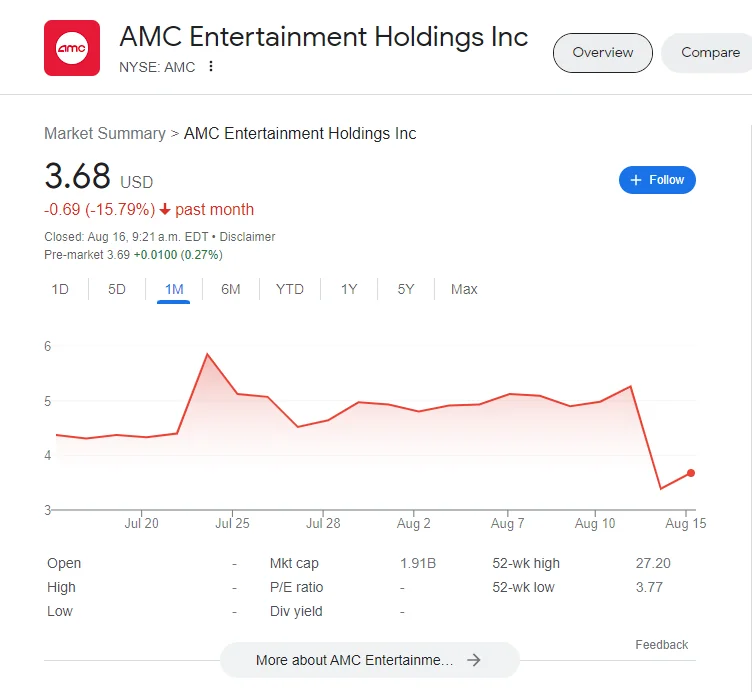

AMC shares were down 25% midway through the trading day after the split, with volume five times usual. Investors in the movie theater circuit will get one share for every ten shares previously held, with the share price rising automatically as a result. Reverse splits are often regarded as potentially dangerous measures made by firms seeking to boost the price of their stock. AMC shares had been trading in the $2 area in recent days; with the split, they are now trading above $14. Investors have expressed concerns about being diluted by the APE swap.

RELATED: AMC Is Abandoning Its Idea To Charge More For The Top Movie Theater Seats

AMC Entertainment can breathe easier after a judge approved a revised shareholder settlement; this means the theater chain could raise additional funds.

When Covid closed theaters for several months, AMC Entertainment became one of a few meme stocks supported by a wave of retail investors who utilized Reddit to coordinate their shares in ailing heritage companies. Individuals now dominate AMC’s shareholder base, which was previously dominated by private equity groups. While the meme-stock phenomena helped AMC avoid the demise of rivals such as Regal Cinemas parent Cineworld and others, CEO Adam Aron has recently issued public warnings about liquidity issues. The company’s total debt load is $9.5 billion.

RELATED: AMC Theaters Will Charge Moviegoers Based On Their Seat Location

Since a Delaware Chancery Court judge declared that the conversion of APE units into common AMC shares can proceed, AMC shares have plummeted rapidly. Shares fell to their lowest level since 2021 immediately after the judgment. The APE effort, dubbed after the “ape” moniker for investors (Aron is known as The Silverback), did not deliver the expected increase. APE shares, which are worth a fraction of what they were when they went public a year ago, have also dropped ahead of the conversion, falling 19% on four times average trading activity today.

In a report to clients this week, B. Riley analyst Eric Wold, a noted bull on the broader exhibition sector, argued that rising synchrony between the movements of AMC and APE shares is a bullish sign. “Investors are beginning to look beyond any potential near-term dilution and instead focus on the opportunity for the company to use the access to incremental equity to both materially reduce debt and strategically expand into higher-growth sectors through acquisitions,” he wrote. “While we understand that some investors may consider the current [adjusted EBITDA] multiple on AMC shares to be extraordinarily high in comparison to both historical levels and the company’s exhibitor peers, we expect management to capitalize on this by pursuing acquisitions in a relatively low-cost currency.”

Download The Radiant App To Start Watching!

Web: Watch Now

LGTV™: Download

ROKU™: Download

XBox™: Download

Samsung TV™: Download

Amazon Fire TV™: Download

Android TV™: Download