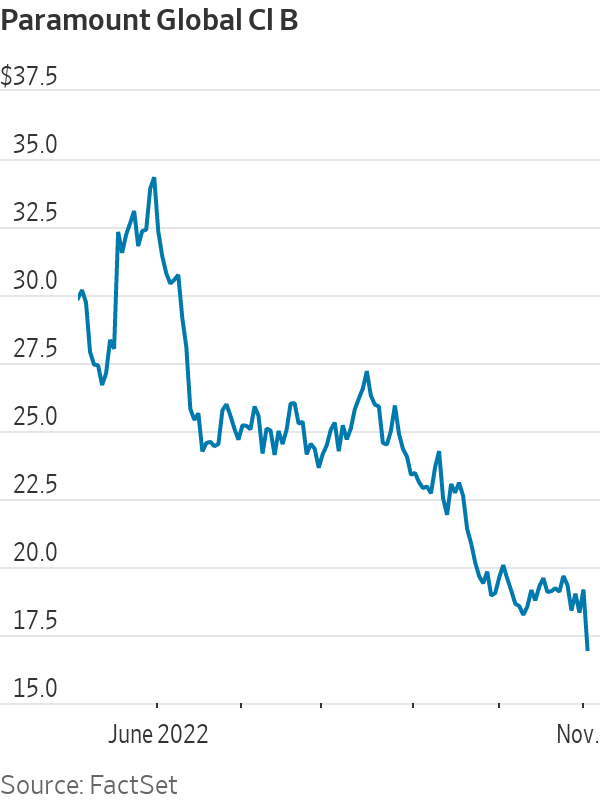

“Concerning.” The “downside risk.” When analyzing Paramount Global’s weaker-than-expected first-quarter results and news of a dividend cut on Thursday, Wall Street analysts used unusually anxious language.

Some investors and company executives may have thought, “Ouch!” After all, the stock took a significant fall as well. As of 10:30 a.m. EST, it had fallen 25.2 percent to $17.12 from a low of $17.03, which was near its 52-week low of $15.29.

“Paramount missed their first-quarter adjusted (operating income before depreciation and amortization (OIBDA) guidance by about 11 percent and cut their dividend, which we take as signs that there is continued estimate risk,” Wells Fargo analyst Steven Cahall said in a report. Cahall has a “underweight” rating on the stock and a $11 price target. Although the streaming division of the entertainment conglomerate reported a larger loss of $511 million in the first quarter, analysts said the outcome was roughly in line with expectations.

But Cahall emphasized that the free cash flow loss for Paramount in particular increased. Wall Street utilizes free cash flow, a measure of profitability, to determine how much money a company has left over after paying all of its debts. A loss forces a company to use debt or its cash reserves. According to the analyst, Paramount reported a $554 million first-quarter free cash flow loss “versus our $234 million loss and (the) Street $411 million loss”.

The company’s quarterly dividend was reduced by the management from 24 cents per share to 5 cents per share in response. Analysts estimated that this would result in annual savings for Paramount of about $500 million.

What would all of this mean, though, for management’s objective of achieving positive free cash flow once more in 2024? Cahall noted in a section titled “The first cut is the deepest” that “the dividend and bigger first-quarter cash outflow is likely to rekindle discussions around cash generation, and what the key drivers are for getting to free cash flow positive.”

A dividend drop, he added, “we think typically signals material shifts in management’s views of risk profiles.” Before management stated on an earnings conference call that it would keep up with the main streaming strategies it had been pursuing up to that point, Cahall said that “at issue for Paramount will be whether it is reassessing the path for direct-to-consumer.” The main point he wanted to make was that “our bias is that first-quarter results and (the) dividend cut likely suggests forward (earnings) estimates have downside risk.”

Peter Supino, an analyst with Wolfe Research, referred to Paramount’s most recent free cash flow update as “concerning.” He now rates the company’s shares with a “underperform” rating and a $12 price target.

“Primarily driven by TV media (unit) softness followed by film, driving lower first-quarter OIBDA,” he said, describing how the quarterly revenue fell short of Wall Street expectations. The overall expectation on Wall Street was for a loss of $203 million, so “the weak results translated to much lower than expected free cash flow,” which he had forecast to achieve a loss of $86 million. This ultimately “saw the quarterly cash dividend cut.”

Supino also examined the state of Paramount’s streaming operations. First-quarter streaming revenue was $1.51 billion, topping analyst estimates of $1.45 billion and market expectations of $1.45 billion “on higher-than-expected subscription revenue,” the analyst added. “This led to a slightly better OIBDA of a $511 million loss,” as opposed to his expectation of a $544 million loss and Wall Street’s $541 million loss estimate. The 60 million subscriber mark for Paramount+ exceeded expectations as well. But compared to his 82.0 million and the Street’s 81.8 million targets, “Pluto monthly active users lagged expectations at 1.5 million net adds for 80.0 million MAUs,” Supino wrote.

Jamie Lumley, an analyst at Third Bridge, spoke on a major Hollywood player’s most recent profits outside of Wall Street. “Paramount’s results came in with a mix of the good, the bad, and the ugly,” he wrote. “Although Paramount+ added 4.1 million subscribers in the last quarter, that is still a significant decrease from the approximately 10 million it had at the end of 2022. This raises doubts about the platform’s potential to keep growing since the firm will struggle to find blockbusters like Top Gun: Maverick to spur subscription growth on a quarterly basis.

According to Lumely, user growth at Pluto TV “has also slowed, while streaming losses increased 31 percent.” “These results show there is a lot of work left to do at Paramount to scale this business,” said one of our experts. “Our experts have repeatedly highlighted the renewed focus on streaming profitability across the industry.” His key lesson is that “Paramount will likely be considering its options for how to reignite growth and recover from a sharp reversal in quarterly earnings” because of the “ongoing decline in the legacy TV Media business and weak theatrical numbers.”

Download The Radiant App To Start Watching!

Web: Watch Now

LGTV™: Download

ROKU™: Download

XBox™: Download

Samsung TV™: Download

Amazon Fire TV™: Download

Android TV™: Download