Despite the announcement of weaker-than-anticipated economic data, stocks rose on Thursday afternoon as Meta’s (META) quarterly results added to a robust week of tech earnings.

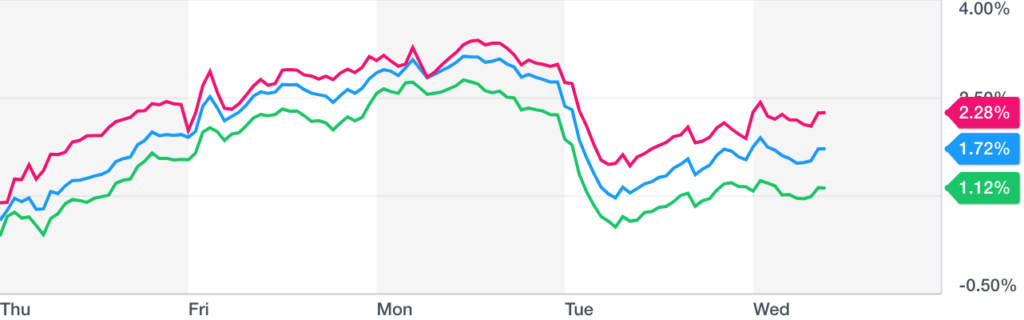

While the Dow Jones Industrial Average (DJI) gained 524 points, or 1.58%, the S&P 500 (GSPC) increased by 1.96%. The heavily tech-focused Nasdaq Composite (IXIC) gained 2.43%.

The U.S. economy expanded at an annual pace of 1.1% in the first quarter, according to the Bureau of Economic Analysis’ advance estimate of first-quarter GDP. Bloomberg questioned economists who predicted 1.9% growth.

Following the release of the company’s better-than-expected first-quarter earnings report after Wednesday’s close, Meta shares ended the day up nearly 14%. In terms of revenue and earnings per share, Meta exceeded analyst estimates. The company also provided guidance for second-quarter revenue in the region of $29.5 billion to $32 billion. Analysts had projected second quarter revenue of $29.48 billion. The stock reached its best closing price in almost 15 months.

After Microsoft (MSFT) and Alphabet (GOOGL) released reports after the market closed on Tuesday, Meta’s results followed suit.

After Meta’s results announcement, Jefferies analyst Brent Thill said on Yahoo Finance Live, “The common theme here is that tech is stronger than most people think.” Yes, we are declining, but conditions are much better than the bears had anticipated.

As a result of Wednesday’s stock decline of 29.75%, pressure on First Republic is growing in the financial industry. The bank is considering “strategic options,” it announced on Monday, after losing more than $100 billion in deposits during the March banking upheaval. First Republic shares gained over 11% intraday on Thursday after losing more than half its market valuation during the previous two trading days.

Shares of Southwest Airlines (LUV) fell 3.3% as the carrier disclosed a first-quarter loss that was greater than anticipated due to a one-time charge made following a cancellation snafu in December.

Despite exceeding Wall Street’s estimates for sales and earnings per share, Caterpillar’s (CAT) stock fell 0.86%. On earnings, the Crocs (CROX) stock also decreased. On worse than anticipated revenue and profit expectations for the second quarter, shares fell by almost 16%.

In noon trade, Lyft shares increased by more than 1.49% as the company confirmed previously rumored layoffs. The corporation is reducing its employees by 26%.

On Thursday, investors also absorbed additional economic data. According to Bloomberg, the Core Personal Consumption Expenditures Price Index, which excludes food and energy, increased to 4.9%, 0.2% more than analysts had predicted. US weekly jobless claims decreased to 230,000 from the previous week. 248,000 claims were what economists polled by Bloomberg had predicted.

In the United States, existing house purchase agreements decreased for the first time since November 2022. The pending home sales index published by the National Association of Realtors fell 5.2% in March. According to Bloomberg, a gain of 0.8% was anticipated.

Download The Radiant App To Start Watching!

Web: Watch Now

LGTV™: Download

ROKU™: Download

XBox™: Download

Samsung TV™: Download

Amazon Fire TV™: Download

Android TV™: Download