Let’s Pretend That You Make Computer Graphic Cards And That An Investor Is Pressing You To Prove That You Are Green.

You understand what to do. You send an email to all of your divisions asking them to add up their energy and carbon footprints. Easy enough. You draft a report outlining a more sustainable future where your offices are outfitted with solar panels and your vehicles are electric.

Your backers praise your first step. How about the quarries where the tantalum or palladium for your transistors was created? Or the silicon wafers that traveled a long supply line to get there? And what happens when consumers receive your product and install it on a laptop or use it continuously in a data center to train an AI model like GPT-4 (or 5)? It will eventually be recycled or put in the garbage. If you count every ton of carbon, the emissions a business produces are much higher than they initially appeared to be.

As part of a campaign to reveal emissions hidden within product life cycles, calls are increasing for legislation that would mandate businesses to go through that rigorous carbon accounting process. The US Securities and Exchange Commission, who oversees Wall Street, contends that each ton of carbon dioxide released poses a risk that investors should be aware of because it could result in expenses and disruption from upcoming carbon regulations around the world as well as annoy clients or staff who are concerned about climate change. The agency proposed regulations last year that would require the majority of the largest businesses to inventory all emissions, including those buried deep within their supply chains. These regulations are anticipated to be finalized next month.

Politicians in California are simultaneously working to compel both public and private businesses operating there to disclose the complete extent of their emissions. In addition to assisting investors, the goal is to force businesses to accept responsibility for the harm they cause and aid customers in spotting fraudulent claims about sustainability. According to the suggested regulations, 5,000 businesses would have to report their emissions to a public database if their revenue is greater than $1 billion.

San Francisco state senator Scott Wiener envisions being able to quickly check the emissions of businesses promoting “climate-friendly” or “low-carbon” goods while strolling down the grocery aisle. He believes that making full disclosures mandatory for businesses will deter greenwashing and “drive enormous companies to do whatever it takes to decarbonize their supply chains.” If customers can readily contrast a bank’s operations with rivals, the bank might reconsider investing in carbon-intensive businesses, for instance.

Demanding these disclosures, according to Cynthia Hanawalt, a senior fellow at Columbia University’s Sabin Center for Climate Change Law, could reveal the real scope of corporate emissions. Currently, the bulk are concealed from view. “At the moment, our system is very haphazard, and voluntary reporting is inconsistent,” she claims. That isn’t beneficial to anyone, with the possible exception of the fossil fuel sector.

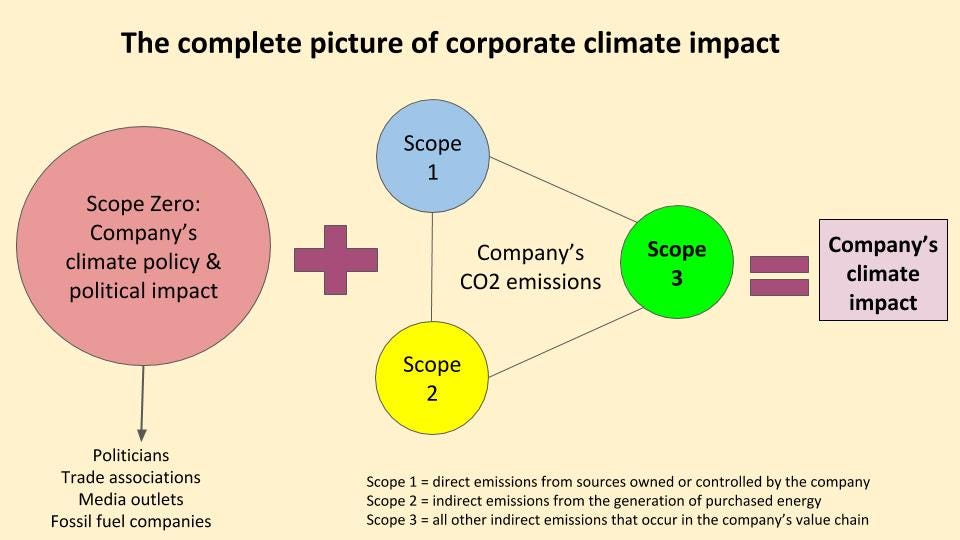

The SEC’s and California’s attempts to compel more openness have encountered resistance. Many businesses willingly disclose some of their carbon emissions, but they tend to concentrate on their own emissions and energy use emissions, which are known as “Scope 1” and “Scope 2,” respectively, in the climate jargon. A business can frequently reduce these emissions the quickest by electrifying trucks or adding solar panels to offices. Everything else is referred to as “Scope 3,” which also includes emissions from product use and supply networks.

These indirect pollutants outweigh all others for many businesses. According to some businesses and business associations, it is unfair to hold them accountable for contamination that they may not even have a direct hand in causing. An oil company might counter that it has no control over how its consumers use its goods, while a manufacturer of graphics cards might claim that it has no control over the coal plants that power the factories of its suppliers in other nations. Customers may fire it even though they drill it.

In California, Wiener and others are attempting to mandate more thorough disclosures for the second time after their first effort, which was opposed by business groups and failed last year by a single vote in the State Assembly, was unsuccessful. According to Brady Van Engelen, a policy advocate for the California Chamber of Commerce, which opposes the measure, “I think there’s a public shaming effort going on here.” The group prefers that the government create incentives for activities that reduce carbon emissions.

Van Engelen says that by requiring suppliers to report on supply chain emissions, the responsibility for carbon accounting will ultimately fall to smaller suppliers. They might not be governed by the laws themselves, but big businesses would pressure them to provide information. Wiener notes that the bill permits the use of formulas and averages to evaluate supply chain emissions, rather than locating each and every supplier, and that he wants the rules, if approved, “to be implementable.”

Critics also point out that by making large companies account for their suppliers, some emissions may end up being counted twice. For instance, if a graphics card’s emissions are reported by both the manufacturer and a business that uses it in PCs or a cloud provider that uses it to train AI models, some emissions may end up being counted twice.

However, proponents of the new regulations claim that their goal is not perfect accounting but rather to compel the level of openness required to begin addressing a systemic issue. Only the biggest companies have the kind of control and visibility into their supply chains to require emissions reductions. Maybe they will be inspired to act if everyone can see those filthy secrets.

According to Sarah Sachs, a senior associate at Ceres, a business organization that is pressing for disclosure regulations at the SEC and in California, “at the end of the day, it’s data.” “All we need is access to this info.

The California regulations, she continues, are complementary to the SEC regulations because they pertain to a slightly different class of businesses. However, Wiener argues that California’s law could also act as a safety net if widely anticipated legal challenges to the SEC’s regulations—some anticipated to come from Republican attorneys general conducting a wider war against corporate sustainability pledges—weaken or delay that effort.

He cites other state environmental regulations, such as California’s requirements for tailpipe pollution from cars. California’s more stringent regulations became de facto national norms when the federal government repealed Obama-era regulations under Trump. Simply put, automakers couldn’t avoid the fourth-largest economy in the globe.

That situation would require passage of the bill into California law. CalChamber was joined by a slew of lobbying organizations last week at a State Senate meeting to highlight the burden that the rules would place on smaller businesses. These organizations included manufacturers, banks, farmers, and other business interests. In order to allow for further debate of the bill, a Democratic member who had backed the earlier version of the legislation abstained from voting. He cited objections from farming organizations.

However, Wiener remained upbeat, noting that a number of businesses, including Patagonia and Ikea, have endorsed the legislation and already conduct comparable reporting on a volunteer basis. Other people, according to Wiener, “I think they’re afraid they’re going to be embarrassed by these disclosures.”

Download The Radiant App To Start Watching!

Web: Watch Now

LGTV™: Download

ROKU™: Download

XBox™: Download

Samsung TV™: Download

Amazon Fire TV™: Download

Android TV™: Download