Alphabet Inc. and Meta Platforms Inc. have dominated the digital advertising market—the source of revenue for the contemporary internet—for more than a decade.

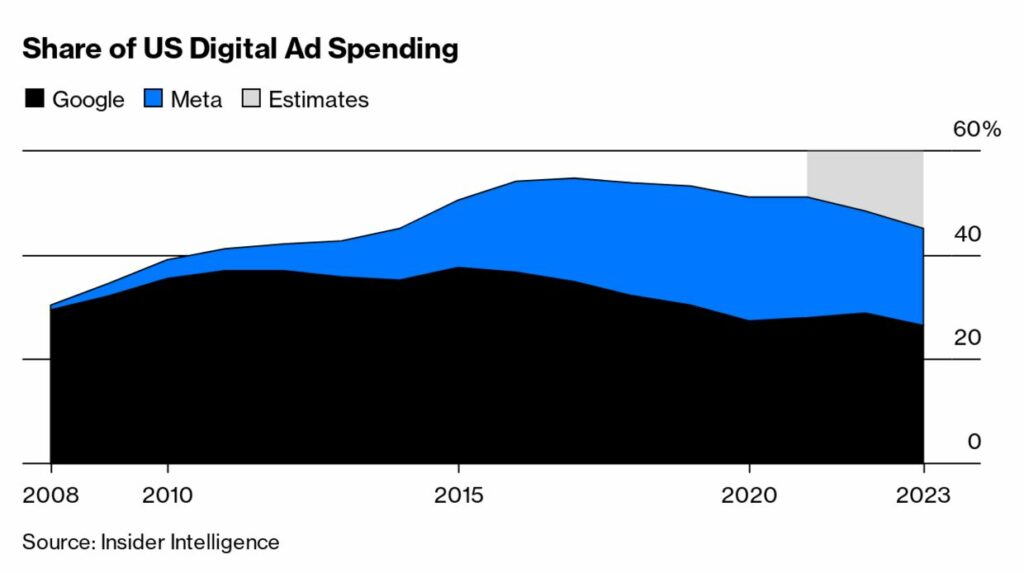

They’ve collected more than half of all online ad dollars, year after year, to the point that competitors and regulators worried there would be no practical way to break their hold.

The two will face rivalry that is more ferocious and well-funded than it has been in a decade, which will present them with some of their greatest challenges to date. The effectiveness of Alphabet and Meta’s iPhone advertisements was severely hampered by a shift in Apple Inc.’s privacy policy, which they are still working to recover from. At a moment when big rivals like Amazon.com, Apple, Netflix, TikTok, and Walmart are luring advertisers faster than ever, this change has created a window. In the meantime, a shaky economy has marketers on edge, so these formidable rivals are competing for a pot of money that no longer appears to expand indefinitely.

The dominant market players from a few years ago don’t have the same growth forecast that they did previously, according to CJ Bangah, a principal at PricewaterhouseCoopers who specializes in advertising. “You’re also seeing new providers enter the market and quickly eat up share.” According to her, this “may potentially yield a different slate of competitors winning.”

Insider Intelligence believes that last year marked the first time since at least 2015 that Meta and Alphabet’s combined share of digital ad revenue in the US, the largest market, fell below 50%. In 2022, Meta experienced its first two quarters of revenue decline, and Alphabet’s sales missed analyst expectations three times in a succession, the company’s longest run of unfavorable surprises since 2015. In 2023, it predicts that they will still be losing territory.

It’s an interesting turn for two companies that have become so powerful that US antitrust enforcers are paying attention. Both created enormous empires by collecting user data and using it to target and customize advertisements, changing the online marketing equation for big brands and small businesses alike. Meta expanded on Facebook by acquiring Instagram and WhatsApp, creating an ad business that fueled the rise of hundreds of direct-to-consumer brands, and Alphabet’s Google search gave marketers a way to put their products in front of people right at the moment they were most inclined to press the “buy” button.

When it released App Tracking Transparency in 2021, Apple gave this model a severe blow. By giving Apple users more control over how they shared data, the feature eventually reduced the effectiveness of online marketing by making it more difficult for businesses to target users and track ads. Smaller companies, who make up the majority of advertisers, have been particularly hurt by this because they lack the funds to purchase TV advertisements and have few other viable options for reaching consumers on a budget. Recently, a new danger to Meta’s advertising business surfaced in Europe after authorities there claimed the company had forcibly obtained users’ consent to use their data for personalized ads.

This year, promotions on e-commerce websites and on streaming TV platforms are anticipated to be two newer ad types that are affordable enough to be viable for smaller companies. The advertising and media behemoth GroupM anticipates a 10% increase in e-commerce ad revenue and an 18% increase in streaming ad revenue in 2023, versus a meager 4.6% increase in the global ad market, which will total $858.6 billion.

According to GroupM, e-commerce advertisements will account for 14% of all worldwide advertising spending this year, generating $121.9 billion in revenue, up from 7% five years ago. This is due to the fact that online merchants like Amazon.com, Target, and Walmart are pitching marketers on the idea of showing them advertisements while customers are actively purchasing and also assisting the businesses in targeting customers by providing information on previous purchases. Brand stores, banner advertisements, and featured placements for search keywords are sprouting up all over their websites, making them accessible to small brands who may have previously preferred social media.

During the epidemic, e-commerce advertisements really took off as marketers tried to keep up with the sudden increase in online retail sales. According to Kate Scott-Dawkins, global head of the business intelligence division at GroupM, once the marketers realized the effectiveness of the advertisements, they persisted. We anticipate that the retail sector will expand more quickly than the entire digital sector, she adds. These businesses are expanding their ad inventory, ad products, and ad formats, which is assisting in their development.

Streaming television, which GroupM estimates will generate $23 billion in revenue in 2023, is the market segment that is expanding at the fastest rate, despite starting from a smaller basis. Marketers want to be where their target audiences are and where customers are. According to Scott-Dawkins, the most talked-about TV shows have emerged from streaming services rather than traditional TV. Smaller channels like Pluto TV, Netflix Inc., and Walt Disney Co. will have more chances to sell advertisements to show if they can continue to attract viewers.

The ability to personalize ads and monitor viewers varies among streaming TV platforms. They can, at the very least, target specific groups based on viewers’ preferences for categories and the programs they watch. Roku Inc., a provider of streaming TV set-boxes, has gone a step further by acquiring a section from TV ratings firm Nielsen Co. that can assist with the placement of personalized ads.

Even though many ad channels have self-service platforms, it still takes some expertise to know what makes a decent connected TV advertisement versus one from Walmart Inc. Mandeep Singh of Bloomberg Intelligence believes that greater fragmentation among advertising platforms may also present opportunities in the advertising technology industry. He predicts a strong 2023 for Trade Desk Inc. and other smaller ad-tech firms, as well as for agencies that can help oversee and optimize where brands spend their money.

Walled gardens used to rule, but Singh claims that they are no longer effective. “Many marketers will be developing their ad ecosystems. There is space for middlemen to assist you in selecting the most appropriate platform for you and your ad budget based on the product you’re attempting to sell.

Download The Radiant App To Start Watching!

Web: Watch Now

LGTV™: Download

ROKU™: Download

XBox™: Download

Samsung TV™: Download

Amazon Fire TV™: Download

Android TV™: Download