According to Ampere Analysis, new major NFL deals with Amazon and YouTube mean that streamers will account for one-fifth of all sports rights spend this year.

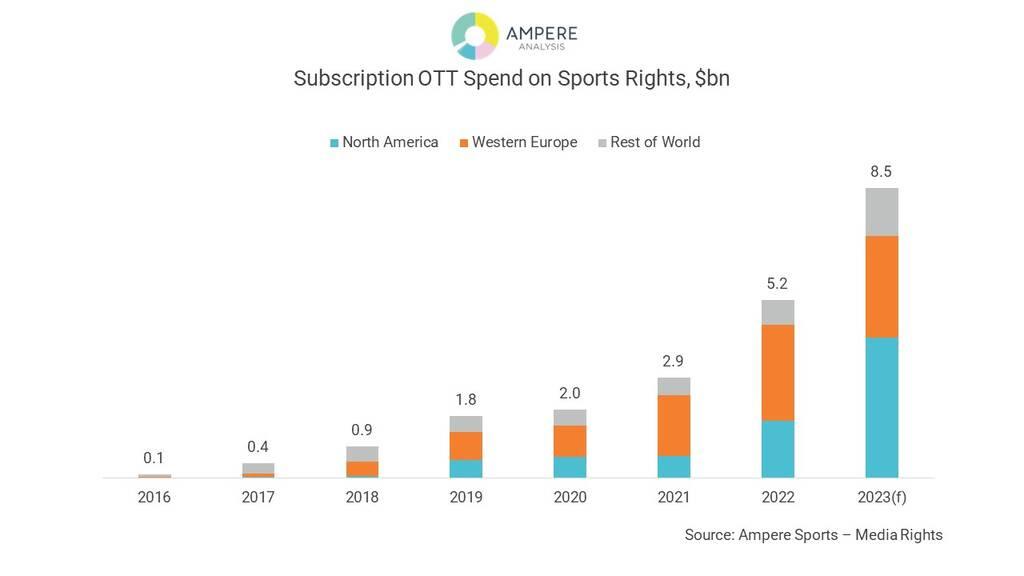

According to a new study from Ampere Analysis’ Sports, which examines the role of sports in the streaming wars, spending by subscription OTT services on sports rights will reach record levels in 2023, reaching $8.5 billion, a 64% increase from 2022.

According to the study, streaming platforms will account for a higher percentage of sports rights spending in 2023, rising from 13% in 2022 to 21%.

This represents a significant shift in how streaming services allocate their funds for programming. According to the researchers, subscription OTT services’ expenditures on sports rights have fallen behind those on original TV and film. In 2022, streaming services like Netflix, Disney+, Prime Video, and Apple TV+ accounted for 28% of the money spent on original programming.

The sports streaming model, however, eventually gained traction as streaming technology advanced and fans’ expectations for being able to watch their preferred sports grew. In addition, the difficult economic outlook for traditional sports broadcasters, such as pay TV channels, commercial channels supported by advertising, and public service broadcasters, encourages rights owners to make a plea to streaming services in order to expand media rights.

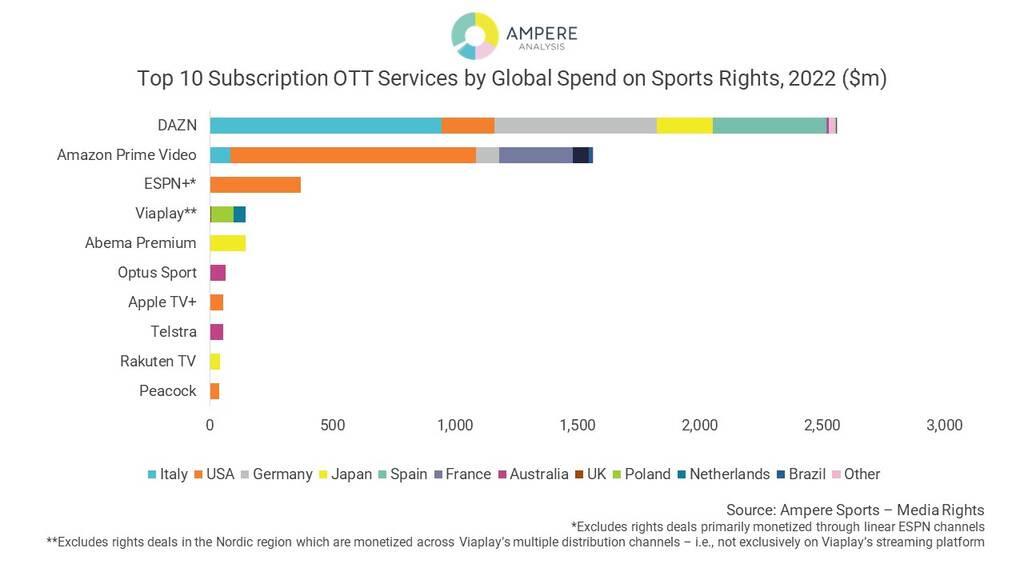

DAZN is paving the way for the expanding investment made by streaming platforms in sports rights, especially in Europe. According to Ampere, the worldwide OTT sports streaming service was responsible for more than half (54%) of all subscription OTT services’ expenditures on sports rights in 2022.

However, as service providers try to stand out from rivals in a more crowded market, sports rights spending has increased recently by general amusement services like Peacock and Viaplay. Six of the top 10 subscription OTT services by global expenditure on sports rights in 2022 were general entertainment services, according to the study.

The NFL’s exclusive contract with Amazon, which began in September 2022, was probably the turning point for sports on OTT platforms for general entertainment. Only YouTube, which also has a contract with the NFL, has since surpassed it as the largest single deal ever signed by a sports streaming service.

Jack Genovese, research manager at Ampere Analysis, said that the move to streaming would take longer for sports than for other categories. “This is partly due to the fact that sports licensing agreements frequently last for several years. It is also because of the importance of sports liberties in general and the delicate issues surrounding how sport is presented and enjoyed. Broadcasters and rights holders equally will continue to favor risk-averse behavior due to the need for high quality, low latency feeds. However, streaming will give sports the chance to experiment with content, monetization, and distribution, which will completely change how sports rights are offered and purchased in the future.

Sports – Media Rights, which records information on sports TV rights in the biggest markets around the world, and Sports – Consumer, a regular series of consumer interviews covering sports fans in 12 countries around the world, are two of the data products used in Ampere’s research.

Download The Radiant App To Start Watching!

Web: Watch Now

LGTV™: Download

ROKU™: Download

XBox™: Download

Samsung TV™: Download

Amazon Fire TV™: Download

Android TV™: Download