The majority of iPhone owners are unaware of one aspect of Apple. Apple, the hardware giant, has spent the last few weeks showcasing new phones, a more durable Apple Watch, and some perplexing new iPad.

The other Apple, which is more subdued and focuses on advertising, is the latter. And Apple is expanding in this area on a daily basis.

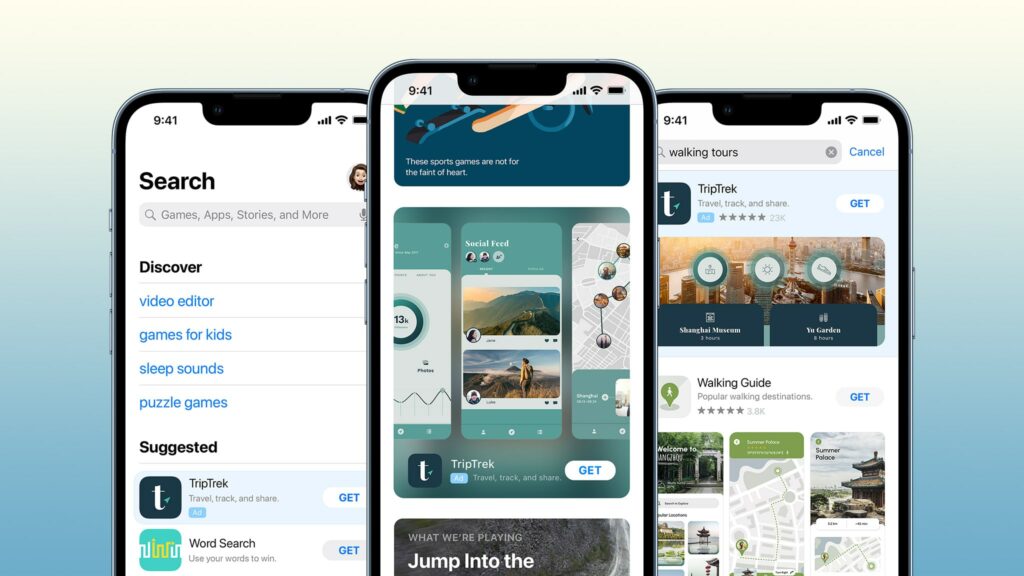

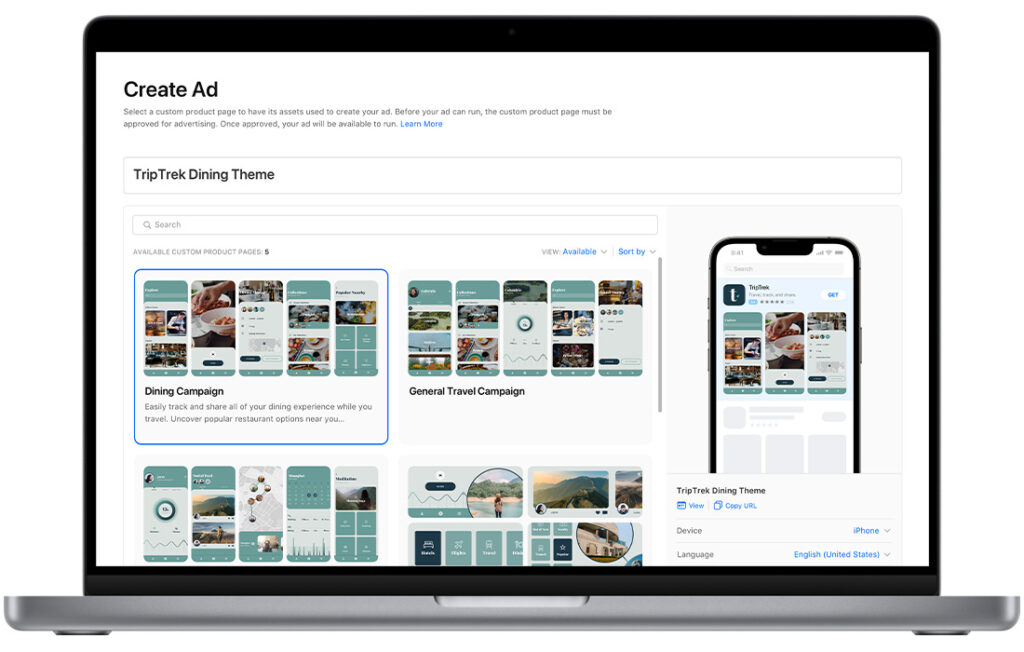

Since 2016, Apple has sold advertisements inside Apple News and the App Store, but in recent months, the company has demonstrated a renewed commitment to seizing market share from Google, Meta, and Amazon. Apple added the ability for businesses to purchase advertisements on the App Store’s home page in June, broadening the range of ways businesses might pay to be seen by their customers. According to job posts from August, Apple may have been developing a self-service platform for companies to reserve advertisements to be shown to users through Apple products. This month, rumors about Apple wooing possible advertisers for Apple TV+ commercials appeared. It’s unclear if the advertisements would take the shape of conventional TV commercials or pre-roll spots similar to those on YouTube.

All of those actions imply that Apple’s customers will start to see more advertisements inside its services and that the business will start to compete more directly with ad-supported rivals like Google and Meta. Michael Cusumano, a professor at the MIT Sloan School of Management, claims that “everybody’s been letting Google and subsequently Facebook steal all this money.” It kind of makes sense for Apple to intervene and declare, “I want a piece of this too.”

It also makes it reasonable that Apple will seek new revenue streams given the stagnating smartphone market and innovation. The company’s growing subscription businesses in news, streaming video, and fitness satisfy the same corporate need for growth. Cusumano thinks that the success of Amazon’s ad business, which shows product advertisements next to search results, may have had some influence on Apple. Since 2016, it has more than tenfold increase, and in 2021, it will generate $31 billion in sales. According to Insider Intelligence, a market research company, Apple earns $4 billion annually through advertisements.

Apple’s advertising endeavor might annoy devoted customers. The company’s normal agreement with customers, who have been conditioned over decades to pay expensive prices for Apple goods that portray a sophisticated, albeit closed-off experience, has been broken by pushing sponsored messaging on people. With apparent reference to Google and Meta, CEO Tim Cook has previously warned that ad-driven business models are fundamentally intrusive of privacy.

Due to a privacy feature added to iOS that has hurt digital ad income at its Big Tech rivals, Apple’s recent interest in advertisements has also come under antitrust scrutiny. People must consent to share data that businesses like Meta used to follow users online under Apple’s App Tracking Transparency, or ATT, which was launched in April of last year. According to one independent estimate, the modifications cost Meta $13 billion in ad revenue. The feature is being looked into by German regulators as possibly anticompetitive because Apple’s tailored adverts, which can target users by age and gender, are exempt from such restrictions.

Shane Bauer, an Apple representative, declined to comment on how the business of the firm is changing, the part that advertising plays in that, or whether ATT was connected to its advertising ambitions. The right to select whether and with whom to share one’s data should belong to the individual, according to Bauer. He asserts that ATT’s policies are uniform for all developers, including Apple, and that the business “never tracks users.”

That doesn’t imply that Apple’s current ad revenues won’t continue to rise. According to Peter Newman, head of forecasting at Insider Intelligence, a company that focuses on following Apple, “It may definitely become a substantial portion of their business.” “They want to become much less dependent on just selling hardware,”

Apple Music and Apple TV+ are two examples of monthly subscription services that Newman cites as having room for commercials. According to him, the company’s video streaming service is noteworthy since, following Netflix’s introduction of an ad-supported tier, Apple is currently one of the only major video streaming services without one. (In April, Apple inked a contract that would allow commercials to be shown during Major League Baseball broadcasts on the streaming service; but, MLB, not Apple, sold the ads.)

The potential size of Apple’s advertising business is far from certain. The company has a lot of space for expansion, but Newman doesn’t think it will ever be able to compete with the biggest digital ad companies. He believes, “I can see Apple being something on the level of Microsoft, maybe a little larger, but much behind the likes of Google and Meta.” Ad income would then be in the tens of billions as opposed to the hundreds of billions. Microsoft estimates that its annual ad revenue is around $10 billion. Google, the largest digital ad network in the world, had nearly $210 billion in revenue last year, with Meta coming in second with $115 billion.

While Apple’s products and services offer a lot of potential ad inventory, according to Newman, they lack the size and profitable opportunities of Google’s search engine, Meta’s billions of users of social apps, or Amazon’s all-encompassing store. However, if persistent reports that Apple is creating its own Google search rival are accurate, the initiative may create abundant new advertising opportunities.

Additionally, the company’s privacy commitments might put a cap on how aggressively it can target ads. According to the investment bank Evercore ISI, Apple’s advertising revenue by 2026 will be $30 billion. That amounts to slightly less than half of the company’s services revenue, or around the size of iPad sales in 2021.

Apple is recruiting a lot of employees in its quest for lucrative advertising. The company’s “complicated and ever-growing platform needs that assist deliver highly optimized advertising content to customers” are mentioned in a job posting for an ad tech engineering manager. According to a Financial Times examination of LinkedIn data, as of September, Apple had about 250 workers working on its ad platforms, and job advertisements indicate aspirations to almost treble that number.

Apple appears to be aware of how being perceived as meddling excessively in online advertisements could damage its reputation or lead to regulatory pressure. It was financed for research by a Columbia Business School professor that was released in April and disproved the notion that ATT gave it an advantage over other internet ad businesses.

But ATT has aided Apple, according to study by Reinhold Kesler of the University of Zurich in Switzerland. Some app developers changed their business models from being free but with adverts to paid models, often with in-app purchases, as a result of the functionality. It’s thought that some businesses have negotiated better prices, but Apple, which takes a 30 percent cut of such payments, benefited from this.

Apple’s biggest difficulty, according to Cusumano of MIT, may be juggling its former reputation for privacy against the data grabbing that digital ad businesses produce. Apple, he claims, is “a meticulously tended walled garden, not this ad-intense world like Google.” It can be challenging to maintain that distinctiveness while while increasing ad revenue. Apple customers are devoted and understanding, according to Kesler. But if they force this in order to meet their forecasts, I wonder if users will be able to ignore it.

Download The Radiant App To Start Watching!

Web: Watch Now

LGTV™: Download

ROKU™: Download

XBox™: Download

Samsung TV™: Download

Amazon Fire TV™: Download

Android TV™: Download