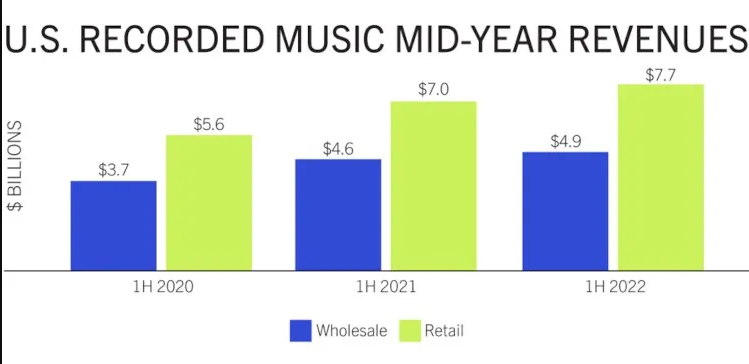

The Recording Industry Association of America (RIAA) estimates that the U.S. recorded music industry generated $7.69 billion in revenue during the first half of 2022; this amount shows a rather modest year-over-year growth of roughly 9.07 percent.

The H1 2022 performance of the domestic music industry was revealed by RIAA authorities today in a succinct report that was emailed to Digital Music News. It is important to emphasize up front that the trade group arrived at the aforementioned number by accounting for “retail value,” which is defined as “the value of shipments at recommended or anticipated list price.”

The domestic recorded music industry’s H1 2022 revenue may, in fact, go below the aforementioned retail value, as evidenced by logic and proof that certain products ultimately sold for less than the “suggested or expected list price.” The RIAA explained that “formats with no retail value equivalent” are “included at wholesale value.”

In any case, the RIAA revealed that streaming, at $6.47 billion over the course of the six months, remained to represent the majority of the total.

The total represents a 9.60 percent YoY increase, however streaming’s share of the overall $7.69 billion in music industry revenue remained constant compared to H1 2021 at almost 84 percent. (Of course, the major labels’ individual earnings reports have taken the overall digital slowdown in 2022 into account.)

According to the report, $5.03 billion of H1 2022’s streaming revenue came from paid subscriptions, including $525 million from “limited-tier” services like Amazon Prime and “music licenses for digital fitness apps.” This represents a YoY increase of about 10.11 percent, compared to 25.69 percent across H1 2020 and H1 2021.

However, according to the resource, on-demand streaming services in the United States had an average of 90 million users in the six months that ended on June 30th, 2022, up from around 82 million in H1 2021.

(Each multi-user plan is categorized as a single subscription; for additional context, the number increased from 72.6 million to 82 million in the first quarter of 2021.) Furthermore, Spotify reported 188 million paid customers for Q2 2022, with around 29 percent/55 million of these subscribers located in North America.)

The remaining $1.5 billion that streaming is estimated to have brought in during H1 2022 was partially driven by ad-supported users, who spent $871.5 million on platforms like Spotify and YouTube as well as social media sites like TikTok and Facebook.

(Some have demanded that the associated income be classified as sync because music featured on TikTok and kindred applications is fairly directly synchronized with visual media; U.S. royalties from this segment were just $178 million in H1 2022 under the RIAA’s categorization.)

The breakdown shows $566.4 million in “digital and customized radio service” revenue, down from $584.8 million in H1 2021, to complete the streaming side. In accordance with expectations, permanent downloads kept declining, falling by double digits in the singles, albums, and ringtones categories alike for a decline of 19.08 percent overall to reach total revenue of $256.2 million.

Last but not least, the analysis shows that during H1 2022, the U.S. recorded music market generated $780.8 million (up 13.29 percent YoY) from physical releases. CD sales decreased ($199.7 million in total, down 2.25 percent YoY), whereas vinyl sales increased by another 22.23 percent to reach $570.2 million. According to the RIAA, vinyl currently accounts for about 75 percent of tangible sales of recorded music in the United States.