Some will point the finger at the dearth of chart-topping records produced during the outbreak. Some will point the finger at a dearth of new contemporary superstars. As seen by Kate Bush’s current, unmatched success, some (hello Merck!) will also point the finger at young people who are merely listening to “old” music as if it were “new.”

But facts are facts, and “current” music in the US isn’t only declining in popularity. In fact, statistically speaking, it is losing popularity.

According to a fresh midyear report released by US industry watcher Luminate (formerly MRC Data / Nielsen Music), this is the case.

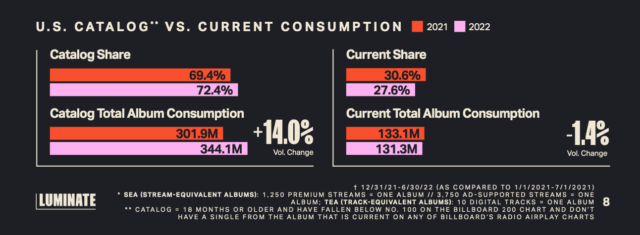

It demonstrates that in the first half of 2022, “Total Album Consumption” of “Current” recorded music declined 1.4 percent in volume compared to the comparable indicator from the same time of 2021.

Obviously, the words in inverted commas there could do with a little unpicking, so here goes:

- Luminate’s ‘Total Album Consumption’ (TAC) metric combines all on-demand track streams, plus all track downloads, plus all album sales on digital and physical formats;

- The formula for ‘TAC’ equates 1,250 premium streams, or 3,750 ad-supported streams, to one album ‘sale’;

- It also equates 10 digital track purchases/downloads to one album ‘sale’;

- In addition, Luminate defines ‘Current’ as anything released in the 18 months prior to it getting streamed/downloaded/purchased;

- Anything older than 18 months when it’s streamed/downloaded/purchased is defined as ‘Catalog’.

131.3 million album-sale-equivalent units (TAC) of “Current” music were registered in the United States in the first half of this year, according to Luminate’s H1 report, which is available for download here.

Compared to the 133.1 million TAC units recorded in the first half of the previous year, that was a decrease of roughly 2 million units (2021).

Once again, losing market share is not the only issue at hand.

We’re talking about the fact that “current” music is really losing ground in terms of the number of streams and purchases it generates.

Everything must be understood in light of a developing market.

Total album consumption in the United States (defined as “Current” + “Catalog”) increased by 9.3 percent YoY in the first half of 2022 to reach 475.4 million, according to Luminate.

This can only indicate one thing: While “Current” music’s popularity declined in the first half of this year, “Catalog” music’s popularity increased significantly, rising by 14.0 percent YoY to 344.1 million TAC units.

In turn, “Catalog” music’s market share continues to outpace “Current” music: According to Luminate’s study, “Catalog” music captured a market share of 72.4 percent in H1 2022, while “Current” music’s share declined by a full 3 percent to just 27.6 percent.

A GROWING PATTERN…

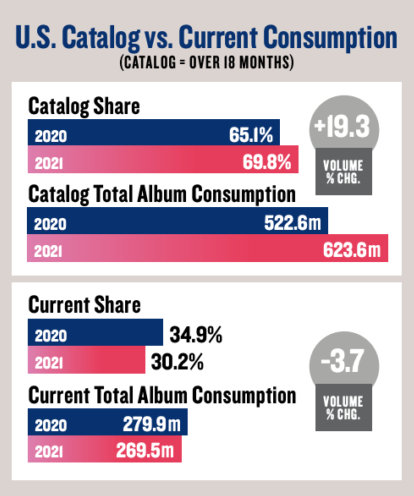

It’s simply the most recent episode in a post-Covid shutdown pattern, but “Current” music’s popularity has decreased in real volume terms before in the United States.

In the 12 months prior to last year, there were 269.5 million “TAC” units of “Current” music, which is a decrease of 3.7 percent from the 279.9 million units registered in FY 2020, according to Luminate’s full-year report for 2021 (download it here) (see below).

Once more, we’re not just discussing a decline in the market share of “Current” music here; we’re also talking about a decline in real streams and sales.

THE STREAMING STORY…

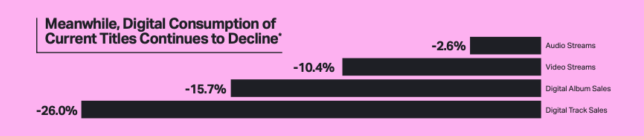

Don’t assume that the demise of the CD or other non-streaming media is somehow lowering the popularity of “current” music.

One of the more startling statistics in the most recent data from Luminate is that in the US in H1 2022, the volume of on-demand audio streaming of “Current” music in particular decreased by 2.6 percent YoY.

And the decline in the volume of “Current” music on video streaming services (-10.4 percent YoY) was even more pronounced.

According to Luminate, the first half of 2022 saw a 19.0 percent YoY rise in the volume of streaming for “catalog” music.

A LACK OF ‘HIGH IMPACTING’ RELEASES?

What’s causing these figures, then?

In its H1 2022 report, Luminate makes an effort to provide some explanations, saying that “this trend is visible in the measurable drop in ‘high impactful’ new releases overall, which are defined as [any] album that debuts on the Billboard 200.”

According to Luminate, there were 126 “high impactful” releases in Q2 of 2021. There were only 102 at the end of Q2 2022.

As a result, we are aware that the number of blockbuster new albums that reach the top of the US charts is declining.

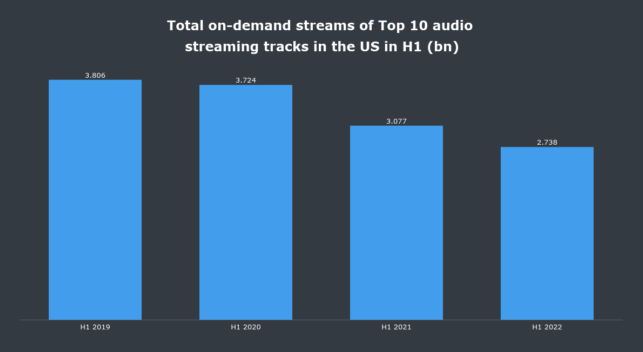

But what about the potential weakening of the influence of popular streaming songs?

THE BIGGER PICTURE…

However, the statistical drop in the appeal of new music rather than “the rise of Catalog” would raise more significant issues for the music industry.

On-demand audio streaming volume for “current” music fell by 2.6 percent YoY in the United States in H1 2022, while on-demand video streaming volume fell by 10.4 percent YoY. However, overall on-demand audio streaming volume increased by a very healthy 24.7 percent in H1 2022 (to 1.6 trillion), and overall on-demand video streaming volume increased by 28.1 percent YoY to 901.5 billion, according to Luminate.

The largest music market in the world sees double-digit annual growth in the number of music streams.

But, for whatever reason, ‘new’ music – be it a temporary trend, or a pattern with more permanence – is officially losing ground.