Does the open internet face challenges?

Since 2021, the amount spent on open programmatic ads has only increased by 3%, according to stock research company Wolfe Research. Within the same time period, walled gardens have expanded by 10%.

Shweta Khajuria, managing director of Wolfe and an internet analyst, stated this is nothing new on Tuesday at AdExchanger’s Programmatic I/O conference in New York City.

For many years, “the open internet has lagged the overall digital advertising market,” according to Khajuria, who also noted that the ad marketplace’s consolidation—a logical byproduct of industry maturation—has contributed to some of this lag.

READ MORE: The First Programmatic Olympics Is Attracting New Advertisers

However, she stated that “the open internet will likely lose less share over time,” partly due to the mixing of performance and brand advertising.

For example, CTV advertising has taken off because consumers utilize it to combine digital-style targeting with mass reach. Businesses such as The Trade Desk have benefited greatly.

An open internet

However, she pointed out that in order for programmatic platforms to capture a larger share of the (slowly) expanding open-internet market, they need to improve their ability to set themselves apart.

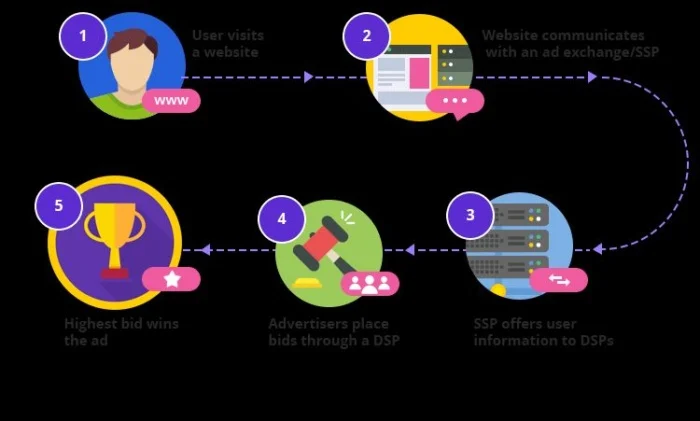

This would account for the reason that programmatic platforms—DSPs and SSPs alike—continue to strive for mutual disintermediation. (See: Activate from PubMatic, ClearLine from Magnite, and OpenPath from The Trade Desk.)

READ MORE: Programmatic Companies Wrestle With ID Bridging And What Counts As Fraud

Consolidation is still taking place, though. This would account for the persistent efforts by programmatic platforms to eliminate middlemen.

The demand side is currently more consolidated than the sale side, which is still very crowded, according to Khajuria, who named The Trade Desk, Amazon, and Google as the three main ad buying platforms.

Khajuria stated, “There are far more SSPs than DSPs today,” citing data from Wolfe Research that indicates the typical web publisher has anywhere from 21 to 30 SSP partners.

However, there’s growing demand on SSPs to stand out and add value. Programmatic platforms need to differentiate themselves by providing competitive pricing and demonstrating that their inventory is both premium and brand safe.

READ MORE: 75% Of All CTV Transactions Are Programmatic

Conversely, Wall Street financiers have specific requirements for publicly traded ad tech firms. For instance, the majority of investors feel confident in publicly traded ad tech firms because of their size, direct agency relationships, and access to first-party data.

Platforms that leverage first-party data to optimize revenue generation for publishers will probably become the leaders in SSPs, according to Khajuria. These platforms have the largest omnichannel scale.

However, until a decision is made in the ongoing Google ad tech antitrust trial, it is difficult to make firm predictions about the future of the open internet.

Google’s difficulties and trials

There are still a few weeks left in the Google study, or possibly even less, and at least several months will pass before a judgment is made.

However, Khajuria stated that Google will probably need to split off at least a portion of its advertising division. Wolfe Research estimates that there is a 45% to 55% chance that GAM or a portion of its ad tech division will spin out. Wolfe’s analysis indicates that the likelihood of regulatory action, such as a fine ranging from 10% to 15%, or Google winning the trial is considerably lower (between 5% and 10%).

According to Khajuria, if Google were to split off even a small portion of its advertising business, it would “level the playing field for SSPs” and benefit the advertising sector as a whole. According to her, Google is currently the undisputed leader in the sell side market.

Greater competition may lead to more competitive pricing if Google were to relinquish part of its ad tech hegemony.

But for the time being, everything is up in the air.

Radiant TV, offering to elevate your entertainment game! Movies, TV series, exclusive interviews, music, and more—download now on various devices, including iPhones, Androids, smart TVs, Apple TV, Fire Stick, and more.